Rising Awareness of Patient Safety

The Lab-synthesized Heparin Market is increasingly influenced by the rising awareness of patient safety among healthcare professionals and patients alike. Concerns regarding the risks associated with animal-derived heparin, such as contamination and variability in potency, have prompted a shift towards synthetic alternatives. Lab-synthesized heparin offers a more controlled and predictable therapeutic profile, which is appealing to clinicians aiming to minimize adverse effects in patients. This heightened focus on patient safety is likely to drive demand for lab-synthesized heparin, as healthcare providers seek reliable and effective anticoagulant therapies. Additionally, educational initiatives aimed at informing healthcare professionals about the benefits of synthetic heparin may further enhance its adoption within clinical settings, thereby contributing to the growth of the Lab-synthesized Heparin Market.

Increasing Demand for Anticoagulants

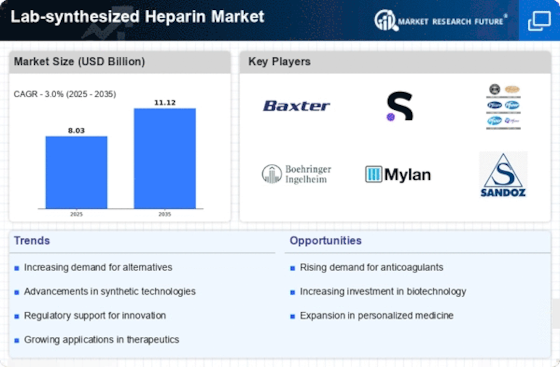

The Lab-synthesized Heparin Market is experiencing a notable surge in demand for anticoagulants, primarily driven by the rising prevalence of cardiovascular diseases and thromboembolic disorders. As healthcare systems increasingly prioritize the management of these conditions, the need for effective anticoagulant therapies becomes paramount. According to recent data, the anticoagulant market is projected to grow at a compound annual growth rate of approximately 7% over the next few years. This growth is likely to bolster the Lab-synthesized Heparin Market, as synthetic heparin offers advantages such as consistent quality and reduced risk of contamination compared to animal-derived alternatives. Consequently, the increasing focus on patient safety and treatment efficacy is expected to further propel the demand for lab-synthesized heparin.

Expansion of Healthcare Infrastructure

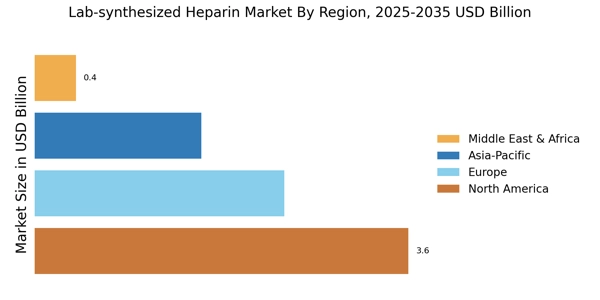

The Lab-synthesized Heparin Market is poised for growth due to the ongoing expansion of healthcare infrastructure in various regions. As healthcare facilities enhance their capabilities to manage chronic diseases and surgical procedures, the demand for effective anticoagulant therapies is expected to rise. Investments in healthcare infrastructure, including the establishment of specialized clinics and hospitals, are likely to create a favorable environment for the adoption of lab-synthesized heparin. Furthermore, as healthcare systems strive to improve patient outcomes, the integration of advanced therapeutic options, such as synthetic heparin, becomes increasingly relevant. This trend may lead to a more robust Lab-synthesized Heparin Market, as healthcare providers seek to implement best practices in anticoagulation management.

Regulatory Support for Synthetic Alternatives

The Lab-synthesized Heparin Market is likely to benefit from increasing regulatory support for synthetic alternatives to traditional heparin. Regulatory agencies are progressively recognizing the advantages of lab-synthesized heparin, including its safety profile and reduced risk of contamination. This shift in regulatory perspective is encouraging manufacturers to invest in research and development, leading to the introduction of innovative synthetic heparin products. Moreover, streamlined approval processes for synthetic drugs may facilitate quicker market entry, allowing companies to respond more effectively to the growing demand for anticoagulants. As regulatory frameworks evolve to support synthetic alternatives, the Lab-synthesized Heparin Market is expected to expand, providing healthcare providers with a broader range of treatment options.

Advancements in Synthetic Production Techniques

Innovations in synthetic production techniques are significantly influencing the Lab-synthesized Heparin Market. Recent advancements in biotechnology and chemical synthesis have enabled the development of more efficient and cost-effective methods for producing heparin. These techniques not only enhance the yield and purity of the product but also reduce the environmental impact associated with traditional extraction methods. As a result, manufacturers are likely to benefit from lower production costs and improved product quality, which could lead to increased market competitiveness. Furthermore, the ability to produce heparin in a controlled laboratory environment ensures consistent supply and quality, addressing concerns related to sourcing from animal tissues. This trend may contribute to a more robust Lab-synthesized Heparin Market, as stakeholders seek reliable and sustainable sources of anticoagulant therapies.