Aging Population

Japan's aging population is influencing the home security-camera market significantly. As the demographic shifts, there is an increasing need for security solutions that cater to the elderly, who may require additional safety measures. Approximately 28% of the population is over 65 years old, leading to a heightened focus on home security systems that provide peace of mind for both seniors and their families. This demographic is likely to prefer user-friendly cameras with features such as motion detection and remote monitoring. Consequently, manufacturers are adapting their products to meet the specific needs of older consumers, thereby expanding the market. The emphasis on safety and independence for the elderly population is expected to drive demand for home security cameras in the coming years.

Rising Crime Rates

The home security-camera market in Japan is experiencing growth due to rising crime rates. Recent statistics indicate that property crimes have increased by approximately 10% over the past year, prompting homeowners to seek enhanced security solutions. This trend is particularly evident in urban areas, where the density of population correlates with higher crime incidents. As a result, consumers are increasingly investing in home security cameras to deter potential intruders and monitor their properties. The demand for advanced surveillance technology is likely to continue as crime rates fluctuate, making it a critical driver for the home security-camera market. Furthermore, the integration of smart technology into these systems allows for real-time monitoring, which appeals to tech-savvy consumers looking for comprehensive security solutions.

Urbanization Trends

The rapid urbanization in Japan is a pivotal driver for the home security-camera market. As more individuals move to urban centers, the demand for residential security solutions increases. Urban areas often face unique security challenges, including higher crime rates and limited space for traditional security measures. The home security-camera market is likely to benefit from this trend, as consumers seek compact and efficient surveillance options. Moreover, the convenience of remote access and monitoring aligns well with the fast-paced lifestyle of urban dwellers. It is estimated that urban populations will continue to grow, potentially reaching 90% by 2030, further propelling the demand for innovative security solutions. This urban-centric growth presents opportunities for manufacturers to develop tailored products that address the specific needs of city residents.

Technological Integration

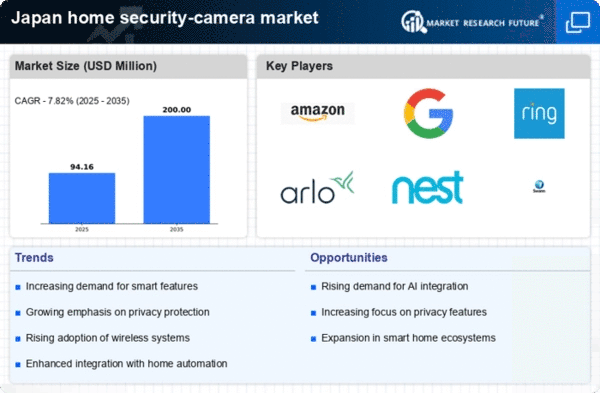

The integration of advanced technologies into the home security-camera market is a significant driver of growth in Japan. Innovations such as artificial intelligence (AI), machine learning, and cloud storage are enhancing the functionality of security cameras. For instance, AI-powered cameras can distinguish between familiar faces and strangers, reducing false alarms and improving user experience. The market is projected to grow at a CAGR of 15% over the next five years, driven by these technological advancements. Additionally, the rise of smart home ecosystems encourages consumers to adopt security cameras that seamlessly integrate with other devices. This trend indicates a shift towards more sophisticated security solutions, as consumers seek products that offer convenience and enhanced security features.

Increased Focus on Privacy

The growing awareness of privacy concerns is shaping the home security-camera market in Japan. Consumers are becoming more discerning about how their data is collected and used, leading to a demand for cameras that prioritize privacy features. This trend is particularly relevant in light of recent discussions surrounding data protection regulations. Approximately 65% of consumers express concerns about unauthorized access to their surveillance footage. As a result, manufacturers are responding by developing security cameras with enhanced encryption and user-controlled privacy settings. This focus on privacy not only addresses consumer concerns but also positions companies favorably in a competitive market. The emphasis on privacy is likely to continue influencing purchasing decisions, making it a crucial driver for the home security-camera market.