Rising Crime Rates

The home security-camera market in Germany is experiencing growth due to rising crime rates in urban areas. According to recent statistics, property crimes have increased by approximately 10% over the past year, prompting homeowners to seek enhanced security measures. This trend indicates a growing awareness of the need for surveillance systems to deter criminal activity. As a result, the demand for home security cameras is likely to rise, with consumers prioritizing features such as high-definition video, night vision, and remote access. The home security-camera market is thus positioned to benefit from this heightened concern for safety, as individuals invest in technology that provides peace of mind and protection for their properties.

Rising Disposable Income

Rising disposable income among German households is contributing to the expansion of the home security-camera market. As economic conditions improve, consumers are more willing to invest in home security solutions. Reports indicate that household disposable income has increased by approximately 5% over the last year, allowing families to allocate funds towards enhancing their home security. This trend suggests a shift in consumer behavior, where security is viewed as a priority rather than an optional expense. The home security-camera market is likely to benefit from this increase in spending power, as more individuals seek to protect their homes with advanced security technologies.

Technological Advancements

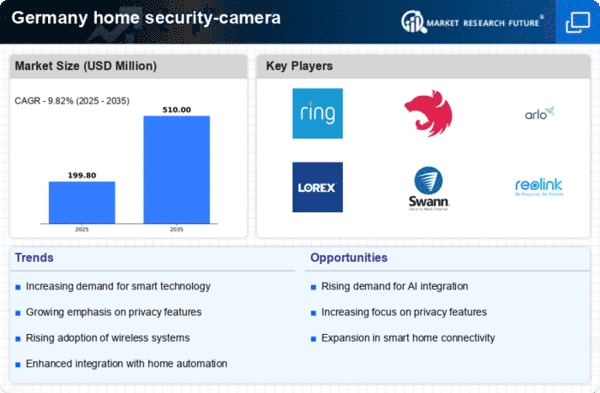

Technological advancements play a crucial role in shaping the home security-camera market in Germany. Innovations such as artificial intelligence, motion detection, and cloud storage are becoming increasingly prevalent. These technologies enhance the functionality of security cameras, allowing for real-time alerts and improved image quality. The integration of smart features, such as facial recognition and two-way audio, is also gaining traction among consumers. As these technologies evolve, they are likely to attract more customers, leading to a projected market growth of around 15% annually. The home security-camera market is thus adapting to these advancements, ensuring that products meet the evolving demands of tech-savvy consumers.

Increased Awareness of Home Security

There is a growing awareness of home security among German homeowners, significantly impacting the home security-camera market. Educational campaigns and media coverage regarding burglary and theft have heightened public consciousness about the importance of surveillance systems. Surveys indicate that nearly 60% of homeowners now consider installing security cameras as a necessary precaution. This shift in perception is driving demand for various types of cameras, including indoor, outdoor, and doorbell cameras. The home security-camera market is responding to this trend by offering a diverse range of products that cater to different security needs, thereby expanding its customer base.

Government Initiatives and Regulations

Government initiatives and regulations aimed at enhancing public safety are influencing the home security-camera market in Germany. Local authorities are increasingly encouraging the installation of surveillance systems in residential areas to combat crime. Financial incentives, such as subsidies for security equipment, are being offered to homeowners, making it more affordable to invest in security solutions. Additionally, regulations regarding data protection and privacy are shaping the features and functionalities of security cameras. The home security-camera market must navigate these regulations while providing effective solutions that comply with legal standards, thus fostering consumer trust and encouraging market growth.