Growing Health Consciousness

The empty capsule market in Japan is experiencing a notable surge due to the increasing health consciousness among consumers. As individuals become more aware of the benefits of dietary supplements and herbal products, the demand for empty capsules is likely to rise. This trend is reflected in the growing sales of nutraceuticals, which have seen an annual growth rate of approximately 8% in recent years. The empty capsule market is poised to benefit from this shift, as manufacturers adapt their offerings to meet the preferences of health-oriented consumers. Furthermore, the inclination towards personalized nutrition is expected to drive innovation in capsule formulations, thereby enhancing the market's growth potential.

Regulatory Support for Nutraceuticals

In Japan, the empty capsule market is bolstered by supportive regulatory frameworks that encourage the development and consumption of nutraceuticals. The Japanese government has implemented policies aimed at promoting health and wellness, which includes the endorsement of dietary supplements. This regulatory environment fosters innovation and ensures that products meet safety and efficacy standards. As a result, the empty capsule market is likely to see increased investment and expansion, with a projected market value reaching approximately $300 million by 2027. The alignment of regulatory support with consumer demand for health products creates a favorable landscape for the empty capsule market.

Rising Popularity of Customizable Supplements

The trend towards customizable supplements is significantly influencing the empty capsule market in Japan. Consumers are increasingly seeking personalized health solutions that cater to their specific needs, which has led to a rise in the demand for empty capsules that can be filled with tailored formulations. This shift is indicative of a broader movement towards individualized health management, with the empty capsule market positioned to capitalize on this trend. Market analysts suggest that the demand for customizable supplements could lead to a growth rate of around 10% annually, as consumers prioritize products that align with their unique health goals.

Technological Innovations in Capsule Production

Technological advancements in capsule production are playing a crucial role in shaping the empty capsule market in Japan. Innovations such as the development of vegetarian and gelatin capsules, along with improvements in manufacturing processes, are enhancing product offerings. These advancements not only improve the quality and safety of capsules but also expand the range of applications for various health products. The empty capsule market is likely to benefit from these innovations, as manufacturers strive to meet the evolving demands of consumers. It is estimated that the market could see a growth trajectory of approximately 7% over the next few years, driven by these technological enhancements.

Increased Investment in Research and Development

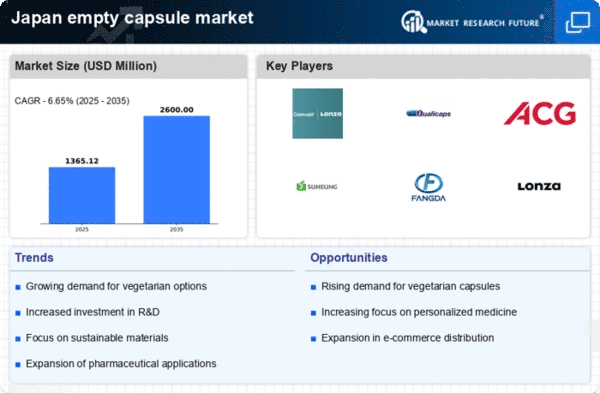

The empty capsule market in Japan is witnessing a surge in investment directed towards research and development (R&D). Companies are increasingly allocating resources to innovate and improve capsule formulations, focusing on aspects such as bioavailability and consumer preferences. This emphasis on R&D is expected to yield new products that cater to the diverse needs of health-conscious consumers. As a result, the empty capsule market could experience a compound annual growth rate (CAGR) of around 9% in the coming years. The commitment to R&D not only enhances product offerings but also strengthens the competitive landscape within the empty capsule market.