Regulatory Support for Nutraceuticals

The empty capsule market is positively influenced by regulatory support for nutraceuticals in the US. Government agencies, such as the FDA, have established guidelines that promote the safety and efficacy of dietary supplements. This regulatory framework encourages manufacturers to invest in high-quality empty capsules, ensuring that products meet safety standards. As a result, the nutraceutical market is projected to reach $70 billion by 2026, with a significant portion of this growth attributed to the increasing use of empty capsules. The emphasis on quality and compliance is likely to drive innovation within the empty capsule market, as companies seek to differentiate their products in a competitive landscape.

Growing Demand for Dietary Supplements

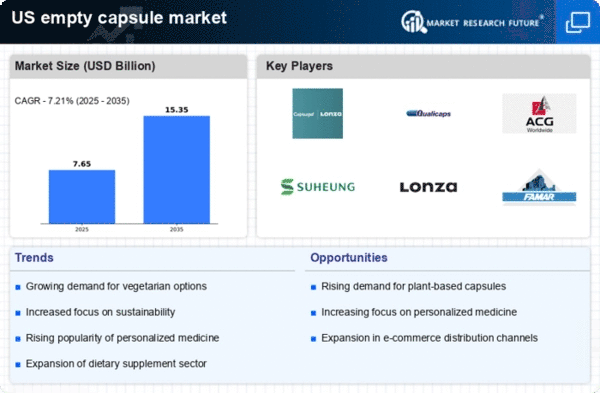

The empty capsule market is experiencing a notable surge in demand for dietary supplements. As consumers increasingly prioritize health and wellness, the market for vitamins, minerals, and herbal supplements is expanding. In the US, the dietary supplement market was valued at approximately $50 billion in 2025, with projections indicating a growth rate of around 8% annually. This trend is driving manufacturers to seek high-quality empty capsules that can effectively deliver these supplements. The preference for vegetarian and gelatin capsules is also rising, as consumers become more health-conscious and environmentally aware. Consequently, the empty capsule market is likely to benefit from this growing demand, as companies strive to meet the needs of health-oriented consumers.

Expansion of E-commerce in Health Products

The empty capsule market is experiencing a transformation due to the expansion of e-commerce platforms for health products. Online retailing has become a preferred shopping method for consumers seeking dietary supplements and pharmaceuticals. In 2025, e-commerce sales in the health and wellness sector are projected to reach $30 billion in the US, significantly impacting the distribution channels for empty capsules. This shift towards online purchasing is prompting manufacturers to enhance their digital presence and optimize their supply chains. As a result, the empty capsule market is likely to benefit from increased accessibility and convenience for consumers, ultimately driving sales and market growth.

Rising Popularity of Personalized Medicine

The empty capsule market is witnessing a shift towards personalized medicine, which is reshaping the pharmaceutical landscape. As healthcare providers increasingly adopt tailored treatment plans, the demand for customized drug delivery systems is on the rise. This trend is particularly relevant for empty capsules, as they can be formulated to meet specific patient needs. The personalized medicine market in the US is expected to exceed $2 trillion by 2025, indicating a substantial opportunity for the empty capsule market. Companies that can offer innovative solutions, such as capsules designed for specific dosages or combinations of active ingredients, may find themselves well-positioned to capitalize on this growing trend.

Technological Innovations in Capsule Manufacturing

The empty capsule market is benefiting from technological innovations in capsule manufacturing processes. Advances in production techniques, such as the use of automated systems and improved materials, are enhancing the efficiency and quality of empty capsules. For instance, the introduction of non-gelatin capsules has opened new avenues for manufacturers, catering to the increasing demand for vegetarian options. The market for these capsules is projected to grow at a CAGR of 7% through 2025, reflecting the industry's adaptability to consumer preferences. As technology continues to evolve, the empty capsule market is likely to see further enhancements in product offerings, leading to increased competitiveness and market share.