Increased Focus on Safety Standards

The circuit breaker market in Japan is witnessing a heightened focus on safety standards, driven by both regulatory requirements and consumer awareness. The government has established stringent safety regulations that mandate the use of high-quality circuit breakers in residential and commercial applications. As a result, manufacturers are compelled to innovate and enhance their product offerings to comply with these standards. In 2025, it is anticipated that the market for safety-compliant circuit breakers will grow by approximately 25%, reflecting the increasing prioritization of safety in electrical installations. This trend not only fosters consumer confidence but also positions the circuit breaker market as a vital component in ensuring the safety of electrical systems throughout Japan.

Rising Demand for Energy Efficiency

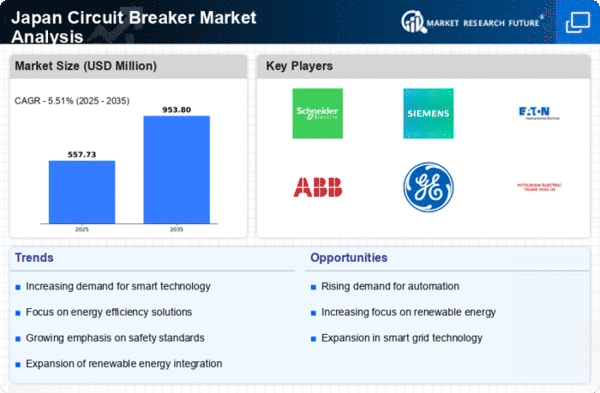

The circuit breaker market in Japan experiences a notable surge in demand driven by the increasing emphasis on energy efficiency. As industries and residential sectors strive to reduce energy consumption, the adoption of advanced circuit breakers that offer enhanced performance and lower energy losses becomes paramount. The Japanese government has implemented various initiatives aimed at promoting energy-efficient technologies, which further propels the market. In 2025, the energy-efficient circuit breaker segment is projected to account for approximately 35% of the total market share, reflecting a significant shift towards sustainable practices. This trend not only aligns with The circuit breaker market as a critical player in Japan's transition towards a more energy-efficient future.

Infrastructure Development Initiatives

Japan's ongoing infrastructure development initiatives significantly impact the circuit breaker market. The government has allocated substantial funding for the modernization of electrical grids and the construction of new facilities, which necessitates the installation of reliable circuit breakers. In 2025, the infrastructure sector is expected to contribute around 40% to the overall demand for circuit breakers, as new projects require advanced safety and protection solutions. This growth is further supported by the need to replace aging infrastructure, which poses safety risks and inefficiencies. Consequently, the circuit breaker market stands to benefit from these investments, as they are integral to ensuring the safety and reliability of electrical systems across various sectors.

Growing Adoption of Renewable Energy Sources

The circuit breaker market in Japan is significantly influenced by the growing adoption of renewable energy sources. As the country aims to increase its reliance on solar, wind, and other renewable energy technologies, the demand for circuit breakers that can effectively manage and protect these systems is on the rise. In 2025, it is estimated that the renewable energy sector will account for approximately 20% of the total circuit breaker market. This shift necessitates the development of specialized circuit breakers that can handle the unique challenges posed by renewable energy integration. Consequently, the circuit breaker market is poised to benefit from this transition, as it plays a vital role in ensuring the stability and safety of renewable energy systems.

Technological Innovations in Circuit Breakers

Technological innovations play a crucial role in shaping the circuit breaker market in Japan. The introduction of smart circuit breakers, which integrate advanced monitoring and control features, is transforming the landscape of electrical management. These innovations enable real-time data analysis and remote management, enhancing the efficiency and reliability of electrical systems. In 2025, the smart circuit breaker segment is projected to capture approximately 30% of the market share, indicating a strong shift towards digital solutions. This trend not only reflects the growing demand for automation in electrical systems but also positions the circuit breaker market as a key player in the broader context of smart grid development in Japan.