Advancements in Automotive Technology

Technological advancements play a pivotal role in shaping the Japan Automobile IoT Market. Innovations in artificial intelligence, machine learning, and big data analytics are enabling automakers to develop smarter vehicles that can communicate with their environment. For example, Japanese manufacturers are increasingly utilizing IoT sensors to enhance vehicle performance and safety features. The integration of these technologies is expected to reduce accident rates by up to 30% in urban areas, thereby attracting more consumers to IoT-enabled vehicles. As these advancements continue to evolve, they are likely to create new revenue streams and business models within the Japan Automobile IoT Market.

Focus on Environmental Sustainability

Environmental sustainability is becoming a central theme in the Japan Automobile IoT Market. With increasing awareness of climate change, consumers and manufacturers alike are prioritizing eco-friendly solutions. The Japanese government has set ambitious targets for reducing carbon emissions, which has led to a rise in the development of electric and hybrid vehicles equipped with IoT technologies. These vehicles not only contribute to sustainability goals but also enhance operational efficiency through real-time monitoring and data analytics. The market for sustainable vehicles is projected to grow by 25% in the next five years, reflecting a significant shift towards greener alternatives in the Japan Automobile IoT Market.

Government Support for IoT Integration

The Japan Automobile IoT Market benefits significantly from robust government support aimed at integrating IoT technologies into the automotive sector. The Japanese government has implemented various initiatives, including funding for research and development, to promote smart mobility solutions. For instance, the Ministry of Land, Infrastructure, Transport and Tourism has established a framework to encourage the adoption of connected vehicles. This support is crucial as it aligns with Japan's vision of becoming a leader in smart transportation, potentially increasing the market size by 15% over the next five years. Furthermore, policies that incentivize manufacturers to adopt IoT technologies are likely to enhance the competitiveness of the Japan Automobile IoT Market.

Rising Consumer Demand for Connected Vehicles

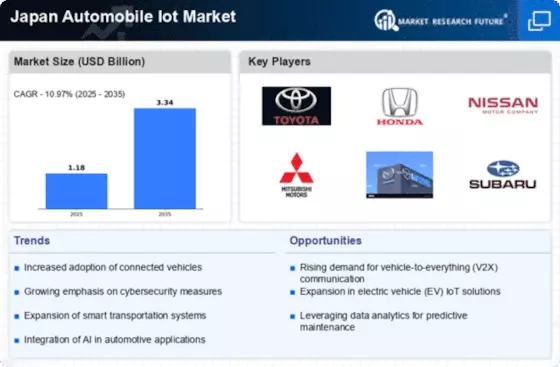

Consumer preferences in Japan are shifting towards connected vehicles, driving growth in the Japan Automobile IoT Market. Recent surveys indicate that approximately 70% of Japanese consumers express a strong interest in vehicles equipped with advanced connectivity features. This demand is fueled by the desire for enhanced safety, convenience, and entertainment options. As automakers respond to this trend, they are increasingly incorporating IoT technologies such as real-time traffic updates, remote diagnostics, and vehicle-to-everything (V2X) communication. The market for connected vehicles in Japan is projected to grow at a compound annual growth rate (CAGR) of 12% through 2028, indicating a substantial opportunity for IoT integration within the automotive sector.

Collaboration Between Automakers and Tech Companies

The Japan Automobile IoT Market is witnessing a surge in collaborations between traditional automakers and technology firms. This trend is driven by the need for expertise in IoT solutions and software development. Partnerships, such as those between Toyota and tech giants like Panasonic, aim to create innovative connected vehicle solutions. These collaborations are essential for accelerating the development of smart mobility services, including autonomous driving and vehicle connectivity. As a result, the market is expected to see a 20% increase in IoT-related investments by 2027, indicating a strong commitment to enhancing the capabilities of the Japan Automobile IoT Market.