Rising Healthcare Expenditure

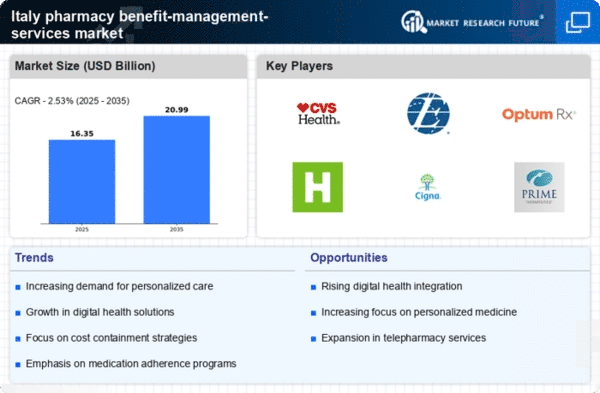

The pharmacy benefit-management-services market in Italy is experiencing growth due to the increasing healthcare expenditure. In recent years, healthcare spending has risen significantly, with estimates indicating that it could reach approximately €200 billion by 2025. This surge in expenditure is driven by an aging population and the rising prevalence of chronic diseases, necessitating more comprehensive pharmacy benefit management services. As healthcare costs escalate, stakeholders are seeking efficient management solutions to optimize drug spending and improve patient outcomes. Consequently, the demand for pharmacy benefit-management-services is likely to increase, as organizations aim to control costs while ensuring access to necessary medications.

Shift Towards Value-Based Care

The transition towards value-based care is reshaping the pharmacy benefit-management-services market in Italy. This model emphasizes patient outcomes and cost-effectiveness rather than the volume of services provided. As healthcare providers and payers increasingly focus on value, pharmacy benefit managers are tasked with demonstrating the effectiveness of medications and therapies. This shift may lead to the adoption of advanced analytics and outcome-based contracts, which could enhance the overall efficiency of pharmacy benefit management. The market is likely to see a growing emphasis on aligning pharmacy benefits with patient health outcomes, thereby driving demand for innovative management solutions.

Regulatory Changes and Compliance

The pharmacy benefit-management-services market is influenced by evolving regulatory frameworks in Italy. Recent legislative changes have introduced stricter compliance requirements for pharmaceutical pricing and reimbursement processes. These regulations aim to enhance transparency and accountability within the healthcare system. As a result, pharmacy benefit managers are compelled to adapt their strategies to align with these new regulations, which may involve increased reporting and data management efforts. The need for compliance not only drives demand for pharmacy benefit-management-services but also encourages innovation in service delivery to meet regulatory standards effectively.

Growing Demand for Specialty Drugs

The increasing prevalence of complex health conditions is driving the demand for specialty drugs in Italy, which in turn impacts the pharmacy benefit-management-services market. Specialty medications often require unique management strategies due to their high costs and specific handling requirements. As the market for specialty drugs expands, pharmacy benefit managers are tasked with developing tailored solutions to manage these therapies effectively. This includes negotiating pricing, ensuring appropriate utilization, and providing patient support services. The growth of specialty drugs is likely to continue influencing the pharmacy benefit-management-services market, as stakeholders seek to navigate the complexities associated with these high-cost therapies.

Technological Advancements in Healthcare

Technological advancements are playing a pivotal role in transforming the pharmacy benefit-management-services market. The integration of digital health solutions, such as telepharmacy and mobile health applications, is enhancing the accessibility and efficiency of pharmacy services. These technologies facilitate better communication between patients, pharmacists, and healthcare providers, leading to improved medication adherence and management. As the Italian healthcare system embraces digital transformation, the demand for pharmacy benefit-management-services is expected to rise, as organizations seek to leverage technology to optimize their operations and enhance patient care.