Rising Cyber Threats

The malware protection market in Italy is experiencing growth due to the increasing frequency and sophistication of cyber threats. Reports indicate that cybercrime incidents have surged by over 30% in recent years, prompting businesses and individuals to seek robust malware protection solutions. This trend is particularly evident in sectors such as finance and healthcare, where sensitive data is at risk. As organizations recognize the potential financial and reputational damage caused by malware attacks, investments in protective measures are becoming a priority. Consequently, the malware protection market is likely to expand as companies strive to safeguard their digital assets against evolving threats.

Increased Remote Work Practices

The rise of remote work practices in Italy has created new challenges for cybersecurity, thereby impacting the malware protection market. With employees accessing corporate networks from various locations and devices, the risk of malware infections has escalated. Organizations are compelled to implement robust malware protection solutions to secure remote access and protect sensitive data. Reports suggest that around 60% of Italian companies have adopted remote work policies, leading to a surge in demand for endpoint security solutions. This trend is likely to continue, further driving the growth of the malware protection market as businesses seek to fortify their defenses against potential cyber threats.

Digital Transformation Initiatives

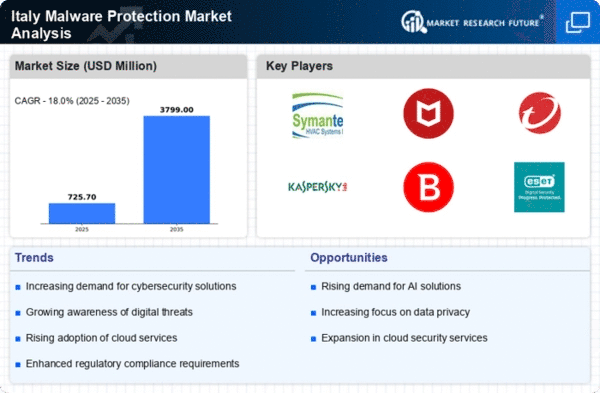

The ongoing digital transformation across various industries in Italy is significantly impacting the malware protection market. As organizations increasingly adopt cloud computing, IoT devices, and remote work solutions, the attack surface for cyber threats expands. This shift necessitates advanced malware protection strategies to mitigate risks associated with new technologies. According to industry estimates, the digital transformation market in Italy is projected to reach €30 billion by 2026, indicating a substantial opportunity for malware protection providers. Companies are likely to prioritize cybersecurity investments to ensure the integrity and security of their digital infrastructures.

Growing Awareness of Cybersecurity

There is a notable increase in awareness regarding cybersecurity among Italian businesses and consumers, which is positively influencing the malware protection market. Educational initiatives and high-profile cyber incidents have underscored the importance of proactive security measures. As a result, organizations are more inclined to invest in comprehensive malware protection solutions. Surveys indicate that approximately 70% of Italian companies now consider cybersecurity a critical component of their operational strategy. This heightened awareness is expected to drive demand for innovative malware protection products and services, fostering growth within the market.

Regulatory Compliance Requirements

In Italy, stringent regulatory frameworks are driving the demand for malware protection solutions. The implementation of the General Data Protection Regulation (GDPR) has heightened awareness regarding data security and privacy. Organizations are now required to adopt comprehensive cybersecurity measures to comply with these regulations, which has led to an increased focus on malware protection. Failure to comply can result in hefty fines, reaching up to €20 million or 4% of annual global turnover, whichever is higher. This regulatory landscape compels businesses to invest in malware protection market solutions to ensure compliance and protect sensitive information.