Supportive Regulatory Framework

Italy's supportive regulatory framework is a crucial driver for the clinical trials market. The Italian Medicines Agency (AIFA) has implemented streamlined processes for trial approvals, which has significantly reduced the time required to initiate clinical studies. This regulatory environment encourages both domestic and international sponsors to conduct trials in Italy, as they benefit from efficient approval timelines. Recent reports suggest that the average approval time for clinical trials in Italy has decreased by approximately 30% over the past few years. Such regulatory enhancements not only facilitate the entry of new therapies into the market but also bolster the overall growth of the clinical trials market, making Italy an attractive destination for clinical research.

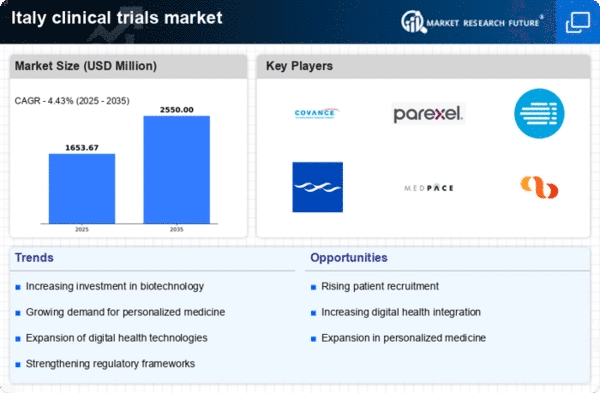

Growing Demand for Innovative Therapies

the clinical trials market in Italy is experiencing a surge in demand for innovative therapies, particularly in the fields of oncology and rare diseases. This trend is driven by an increasing prevalence of chronic conditions and a growing patient population seeking advanced treatment options. According to recent data, the Italian pharmaceutical sector has allocated approximately €2.5 billion towards research initiatives aimed at developing novel therapies. This investment is likely to enhance the clinical trials market, as pharmaceutical companies seek to validate their innovative products through rigorous testing. Furthermore, the collaboration between academic institutions and industry players is fostering a conducive environment for clinical research, thereby propelling the growth of the clinical trials market.

Increased Collaboration Among Stakeholders

the clinical trials market in Italy is seeing increased collaboration among various stakeholders, including pharmaceutical companies, academic institutions, and healthcare providers. This collaborative approach is fostering innovation and enhancing the efficiency of clinical trials. Partnerships between industry and academia are particularly noteworthy, as they leverage shared resources and expertise to advance research initiatives. Recent data indicates that collaborative trials account for nearly 40% of all clinical studies conducted in Italy. This trend is likely to continue, as stakeholders recognize the benefits of pooling resources and knowledge to expedite the development of new therapies. Such collaborations are expected to further strengthen the clinical trials market.

Rising Patient Awareness and Participation

Rising patient awareness regarding clinical trials is significantly impacting the clinical trials market in Italy. As patients become more informed about the potential benefits of participating in clinical research, enrollment rates are likely to increase. Educational campaigns and outreach programs are being implemented to enhance understanding of clinical trials among the general public. Recent surveys indicate that approximately 70% of patients are now aware of clinical trials as a treatment option, compared to just 50% a few years ago. This heightened awareness is expected to lead to greater patient participation, which is essential for the successful execution of clinical trials. Consequently, the clinical trials market may experience growth as more patients engage in research opportunities.

Technological Advancements in Clinical Research

Technological advancements are playing a pivotal role in shaping the clinical trials market in Italy. The integration of digital tools, such as electronic data capture (EDC) systems and telemedicine, is streamlining the clinical trial process, enhancing data accuracy and patient engagement. Recent statistics indicate that approximately 60% of clinical trials in Italy are now utilizing some form of digital technology, which not only expedites the trial process but also reduces operational costs. This shift towards technology-driven solutions is likely to attract more sponsors and increase the number of trials conducted, thereby positively impacting the clinical trials market. As technology continues to evolve, it may further transform the landscape of clinical research in Italy.