- DEC 2025: Europe continues to strengthen its position as a global clinical research hub with harmonized regulations under the EU Clinical Trials Regulation (CTR). Sponsors report improved approval timelines and greater transparency in trial data submissions. Several countries are enhancing infrastructure for decentralized and hybrid trials, boosting patient recruitment and retention. Investments in rare-disease and personalized-medicine studies are rising across the region.

- Q2 2025: Making Europe more attractive for conducting clinical trials The ECRAID network, developed from the COMBACTE projects, now connects more than 1,200 hospital sites in 42 countries, providing a single access point for clinical trials on antimicrobial-resistant drugs and enhancing Europe's infrastructure for multi-country clinical research.

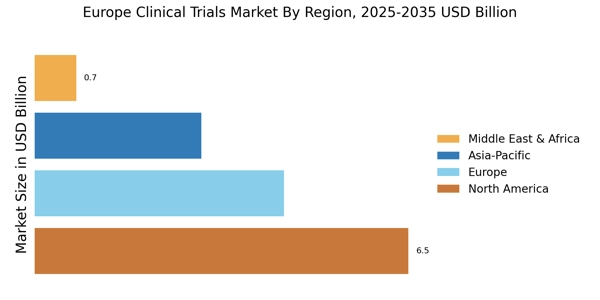

Europe Clinical Trials Market Trends

- Increasing number of clinical trials

In recent years, clinical trials of various drugs and procedures in the European market have increased significantly due to the supportive regulatory environment. Europe has well-established regulatory bodies such as the European Medicines Agency (EMA) and national regulatory agencies that ensure the safety and efficacy of clinical trials. The introduction of the EU Clinical Trials Regulation has streamlined the approval process and harmonized regulations across European countries, making it easier for sponsors to initiate clinical trials.

According to the EMA, there has been a consistent increase in the number of clinical trial applications submitted, reflecting the growing interest in conducting trials in Europe. Moreover, the region has a strong network of research institutions, academic centers, and hospitals with state-of-the-art facilities. These facilities provide the necessary infrastructure for conducting clinical trials, including specialized equipment, laboratories, and skilled healthcare professionals.

Furthermore, there is a growing trend towards collaborative networks and partnerships in the European clinical trials market. Collaborative networks, such as the European Clinical Research Infrastructure Network (ECRIN), facilitate the coordination of multinational trials and provide a platform for knowledge exchange among researchers, sponsors, and regulatory authorities. This trend promotes efficiency in trial design, participant recruitment, and data sharing, leading to an increase in the number of clinical trials conducted in Europe

Europe Clinical Trials Market Segment Insights

Europe Clinical Trials Market Phase Insights

The Europe Clinical Trials Market, based on phase, includes, phase I, Phase II, Phase III, Phase IV. Phase III held the largest market share and phase I is the fastest growing market in the forecast period 2023-2032.

The primary objective of Phase I trials is to establish a safe and tolerable dosage range for subsequent phases. These studies help researchers determine the Maximum Tolerated Dose (MTD) and explore dose escalation strategies. Moreover, Phase I trials provide crucial insights into the drug's behavior within the body, its absorption, distribution, metabolism, and excretion. Phase III trials also continue to assess the safety profile of the investigational treatment in a larger population. Adverse events and side effects are closely monitored, allowing for a comprehensive understanding of the treatment's risk-benefit profile.

Phase III trials may also explore subgroup analyses to identify specific patient populations that may benefit the most from the treatment.

Phase IV trials involve the observation and evaluation of patients who are prescribed the approved treatment as part of their routine clinical care. These trials aim to assess the treatment's performance in real-world settings, outside the controlled environment of earlier phases. They provide insights into the treatment's long-term safety profile, potential rare adverse events, drug interactions, and its effectiveness in broader patient populations.

Figure 2: Europe Clinical Trials Market, by Phase, 2023 & 2032 (USD Billion)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Europe Clinical Trials Market Study Design Insights