Market Growth Projections

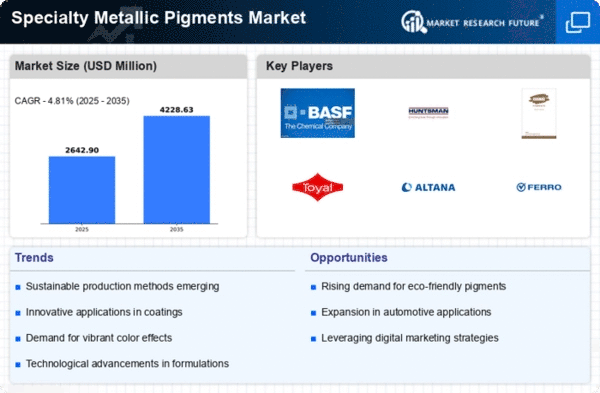

The Global Specialty Metallic Pigments Market Industry is projected to experience substantial growth, with estimates indicating a market value of 2.52 USD Billion in 2024 and a potential increase to 4.22 USD Billion by 2035. This growth trajectory suggests a robust demand for specialty metallic pigments across various sectors, driven by innovations and evolving consumer preferences. The anticipated CAGR of 4.81% from 2025 to 2035 further underscores the market's potential, indicating that manufacturers and stakeholders should strategically position themselves to capitalize on emerging opportunities within the Global Specialty Metallic Pigments Market Industry.

Growth in Consumer Electronics

The Global Specialty Metallic Pigments Market Industry is significantly influenced by the expanding consumer electronics sector. With the proliferation of smartphones, tablets, and other electronic devices, manufacturers increasingly utilize specialty metallic pigments to enhance product aesthetics and functionality. These pigments provide unique visual effects and improved thermal management, which are crucial in high-performance electronics. As the market is projected to reach 4.22 USD Billion by 2035, the demand for visually striking and functional coatings in consumer electronics is likely to drive innovation and growth within the Global Specialty Metallic Pigments Market Industry.

Rising Demand in Automotive Sector

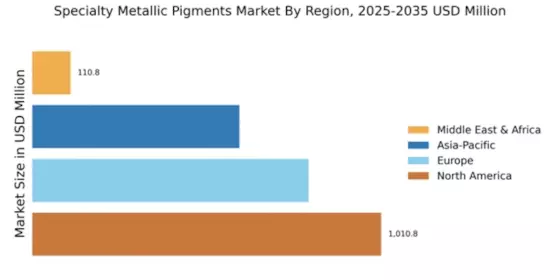

The Global Specialty Metallic Pigments Market Industry experiences a notable surge in demand from the automotive sector, driven by the increasing preference for aesthetically appealing vehicle finishes. Specialty metallic pigments enhance the visual appeal and durability of automotive coatings, contributing to a projected market value of 2.52 USD Billion in 2024. As manufacturers strive to differentiate their products, the incorporation of these pigments becomes essential. The automotive industry's focus on sustainability and lightweight materials further propels the demand for innovative coatings, suggesting a robust growth trajectory for the Global Specialty Metallic Pigments Market Industry.

Innovations in Coating Technologies

Innovations in coating technologies play a pivotal role in shaping the Global Specialty Metallic Pigments Market Industry. Advances in application techniques, such as powder coating and liquid coating, enable manufacturers to achieve superior finishes and performance characteristics. These technological improvements not only enhance the aesthetic appeal of products but also improve their resistance to environmental factors. As a result, the market is expected to grow at a CAGR of 4.81% from 2025 to 2035. This growth indicates a strong potential for specialty metallic pigments to become integral components in various applications, further solidifying their position in the Global Specialty Metallic Pigments Market Industry.

Increasing Use in Packaging Applications

The Global Specialty Metallic Pigments Market Industry witnesses a growing application in packaging, particularly in the food and beverage sector. Specialty metallic pigments are increasingly utilized in packaging materials to enhance visual appeal and provide a premium look, which can influence consumer purchasing decisions. The trend towards sustainable packaging solutions also encourages the use of these pigments, as they can be incorporated into eco-friendly materials. This shift is likely to contribute to the overall growth of the market, as brands seek to differentiate their products through innovative packaging solutions, thereby reinforcing the relevance of the Global Specialty Metallic Pigments Market Industry.

Regulatory Support for Sustainable Practices

Regulatory support for sustainable practices is becoming a significant driver for the Global Specialty Metallic Pigments Market Industry. Governments worldwide are implementing stringent regulations aimed at reducing environmental impact, which encourages manufacturers to adopt eco-friendly pigments and coatings. This shift towards sustainability not only aligns with consumer preferences but also fosters innovation in the development of new products. As the market adapts to these regulatory changes, it is likely to witness increased investment in research and development, further enhancing the growth potential of the Global Specialty Metallic Pigments Market Industry.