Organic Pigments Market Summary

As per Market Research Future analysis, the Organic Pigments Market Size was estimated at 5973.61 USD Million in 2024. The Organic Pigments industry is projected to grow from USD 6253.89 Million in 2025 to USD 9892.05 Million by 2035, exhibiting a compound annual growth rate (CAGR) of 4.69% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Organic Pigments Market is currently experiencing a robust shift towards sustainability and innovation.

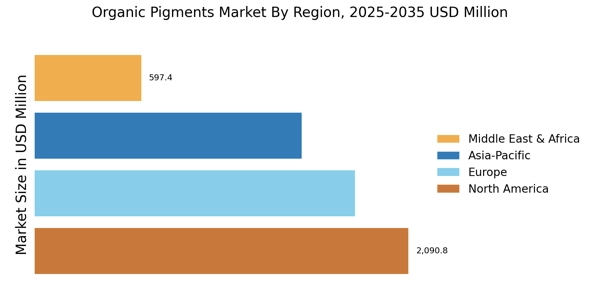

- North America remains the largest market for organic pigments, driven by a strong demand for eco-friendly products.

- Asia-Pacific is identified as the fastest-growing region, reflecting an increasing focus on sustainable manufacturing practices.

- Phthalocyanine pigments dominate the market, while high-performance pigments are emerging as the fastest-growing segment.

- The rising demand for eco-friendly products and stringent environmental regulations are key drivers propelling market growth.

Market Size & Forecast

| 2024 Market Size | 5973.61 (USD Million) |

| 2035 Market Size | 9892.05 (USD Million) |

| CAGR (2025 - 2035) | 4.69% |

Major Players

BASF SE (DE), Clariant AG (CH), DIC Corporation (JP), Huntsman Corporation (US), Kremer Pigments GmbH & Co. KG (DE), Lanxess AG (DE), Sun Chemical Corporation (US), Toyo Ink SC Holdings Co., Ltd. (JP), Ferro Corporation (US)