Increased Focus on Nutritional Enhancement

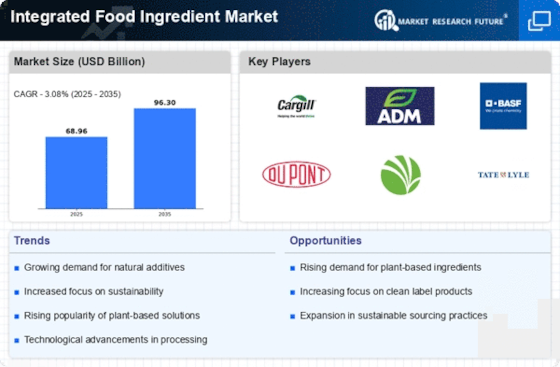

The Integrated Food Ingredient Market is witnessing a surge in demand for ingredients that enhance the nutritional profile of food products. As consumers become more aware of the importance of nutrition in their diets, there is a growing interest in functional ingredients that offer health benefits beyond basic nutrition. This trend is supported by market data indicating that the functional food ingredient segment is anticipated to grow at a rate of 8% annually over the next few years. Ingredients such as probiotics, prebiotics, and fortified vitamins are gaining traction as consumers seek to improve their overall health and well-being. Manufacturers are increasingly incorporating these ingredients into their products to cater to this demand, thereby driving innovation and expansion within the Integrated Food Ingredient Market.

Technological Advancements in Food Processing

Technological innovations are playing a pivotal role in shaping the Integrated Food Ingredient Market. Advances in food processing technologies, such as high-pressure processing and enzymatic treatments, enable manufacturers to enhance the quality and functionality of food ingredients. These technologies facilitate the development of healthier and more sustainable food products, which align with evolving consumer preferences. Market data suggests that the adoption of these technologies could lead to a reduction in production costs by up to 15%, thereby increasing profitability for manufacturers. Furthermore, the integration of automation and artificial intelligence in food production processes is streamlining operations, improving efficiency, and ensuring consistent product quality. As a result, the ongoing technological advancements are expected to significantly influence the growth trajectory of the Integrated Food Ingredient Market.

Rising Consumer Demand for Clean Label Products

The Integrated Food Ingredient Market is experiencing a notable shift towards clean label products, driven by consumer preferences for transparency and natural ingredients. As consumers become increasingly health-conscious, they seek products that are free from artificial additives and preservatives. This trend is reflected in market data, indicating that the clean label segment is projected to grow at a compound annual growth rate of approximately 7% over the next five years. Manufacturers are responding by reformulating existing products and developing new offerings that align with these consumer demands. This shift not only enhances product appeal but also fosters brand loyalty, as consumers are more likely to choose brands that prioritize ingredient integrity. Consequently, the emphasis on clean labels is likely to propel growth within the Integrated Food Ingredient Market.

Expansion of E-commerce and Online Retail Channels

The rise of e-commerce is transforming the way consumers access food products, significantly impacting the Integrated Food Ingredient Market. Online retail channels are becoming increasingly popular, providing consumers with greater convenience and access to a wider variety of food ingredients. Market data indicates that online grocery sales are projected to grow by over 20% in the coming years, reflecting a shift in consumer shopping behavior. This trend is prompting manufacturers to enhance their online presence and develop strategies to reach consumers through digital platforms. Additionally, the ability to offer detailed product information and customer reviews online is fostering informed purchasing decisions. As e-commerce continues to expand, it is likely to play a crucial role in shaping the future landscape of the Integrated Food Ingredient Market.

Growing Interest in Sustainable Sourcing Practices

Sustainability is becoming a central theme within the Integrated Food Ingredient Market, as consumers increasingly prioritize products that are sourced responsibly. The demand for sustainably sourced ingredients is on the rise, driven by concerns over environmental impact and ethical production practices. Market data suggests that the sustainable food ingredient segment is expected to grow at a rate of 6% annually, as consumers seek to support brands that align with their values. Manufacturers are responding by implementing sustainable sourcing practices, such as using organic ingredients and reducing carbon footprints. This commitment to sustainability not only appeals to environmentally conscious consumers but also enhances brand reputation. As the focus on sustainable practices intensifies, it is likely to significantly influence purchasing decisions within the Integrated Food Ingredient Market.