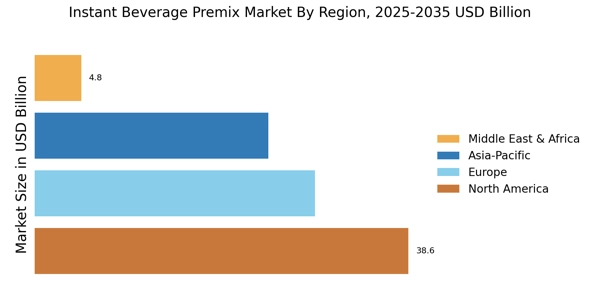

By Region, the study provides market insights into North America, Europe, Asia-Pacific, and the Rest of the World. The Asia Pacific Instant Beverage Premix market was worth USD 41.77 billion in 2022 and is expected to grow at a significant CAGR during the study period, with China being the major revenue contributor. The main driver of the rise in demand for instant beverage premix in the coming years is the growing urbanization in nations like China and India.

Besides, significant lifestyle changes and rising disposable incomes in developing countries such as India and others have changed consumer consumption patterns, driving demand for instant beverage premixes. Millennials are becoming increasingly popular in developing economies like China and India. Regional businesses prioritize R&D investments to maintain flavor and lengthen the shelf life of their products to remain competitive.

Further, the major countries studied in the market report are the U.S., Germany, Canada, France, the UK, Spain, Italy, Japan, India, Australia, China, South Korea, and Brazil.

Figure 2: INSTANT BEVERAGE PREMIX MARKET SHARE BY REGION 2022 (%)

The European instant beverage premix market has the second-largest market share, owing to the region's rapid increase in instant tea and coffee consumption. According to Coherent Market Insights, Russia is one of the most important tea markets, with approximately 88% of Russians drinking tea. This leads to an increase in the number of instant tea premix consumers in Russia, which contributes significantly to the growth of the Europe instant beverage premix industry. Moreover, rising demand for on-the-go beverages will drive instant premix market growth in the coming years.

Further, the German instant beverage premix market held the largest market share, and the UK instant beverage premix market was the fastest-growing market in the European region.

The North American Instant Beverage Premix Market is expected to grow at the fastest CAGR from 2024 to 2032. With the increased presence of beverage consumers in corporate offices, demand for premixes is expected to rise across the region. As many reputable manufacturers and technology companies established their headquarters in the region, the network of offices has expanded at a commendable rate. The demand for instant beverage premixes from corporate cafeterias is rising as more employees increase their daily coffee consumption. The demand for instant foods and beverages drives rapid growth in the region's processed food and beverage industry.

Besides, the region has seen a significant rise in the demand for instant beverages for health and leisure. Several companies are forming alliances to launch such products and increase their customer base. Moreover, Canada’s instant beverage premix market held the largest market share, and the U.S. instant beverage premix market was the fastest-growing market in the North American region.