Rising Livestock Production

The feed premix market is experiencing growth due to the increasing livestock production in the United States. As the demand for meat, dairy, and eggs rises, farmers are seeking efficient ways to enhance animal health and productivity. In 2025, the livestock sector is projected to grow by approximately 2.5%, leading to a corresponding increase in the need for high-quality feed premixes. This trend indicates that producers are investing in specialized formulations to meet nutritional requirements, thereby driving the feed premix market forward. Furthermore, the emphasis on optimizing feed conversion ratios is likely to encourage the adoption of advanced premix solutions, which can improve overall livestock performance and profitability.

Focus on Sustainable Practices

The feed premix market is increasingly influenced by a focus on sustainable agricultural practices. As environmental concerns grow, livestock producers are seeking ways to reduce their carbon footprint and improve resource efficiency. This shift is leading to a higher demand for feed premixes that incorporate sustainable ingredients and production methods. In 2025, it is projected that the market for sustainable feed products will expand by 10%, as consumers and regulatory bodies alike push for more environmentally friendly practices. Consequently, feed manufacturers are responding by developing premixes that not only meet nutritional needs but also align with sustainability goals, thereby enhancing their market position.

Regulatory Support for Animal Nutrition

The feed premix market benefits from supportive regulatory frameworks that promote animal nutrition and welfare. In the United States, government initiatives aimed at enhancing food safety and quality standards have led to increased scrutiny of animal feed products. This regulatory environment encourages manufacturers to innovate and develop high-quality feed premixes that comply with safety standards. As a result, the market is witnessing a shift towards more scientifically formulated products that ensure optimal animal health. The U.S. Department of Agriculture (USDA) has also been active in promoting research and development in animal nutrition, which further supports the growth of the feed premix market.

Technological Innovations in Feed Formulation

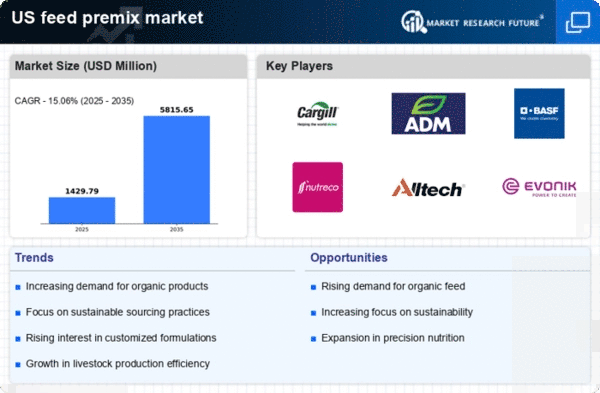

Technological advancements are playing a crucial role in shaping the feed premix market. Innovations in feed formulation techniques, such as precision nutrition and data analytics, are enabling manufacturers to create customized premixes tailored to specific animal needs. These technologies allow for more efficient use of ingredients, reducing waste and improving overall feed efficiency. In 2025, the adoption of such technologies is expected to increase by 20%, as producers recognize the benefits of optimizing feed formulations. This trend not only enhances animal health and productivity but also contributes to the sustainability of livestock operations, thereby driving growth in the feed premix market.

Consumer Preference for Quality Animal Products

There is a notable shift in consumer preferences towards high-quality animal products, which is influencing the feed premix market. As consumers become more health-conscious, they are increasingly demanding meat and dairy products that are free from antibiotics and hormones. This trend compels livestock producers to adopt feed premixes that enhance the nutritional profile of their products while ensuring animal welfare. In 2025, it is estimated that the market for organic and natural animal products will grow by 15%, prompting feed manufacturers to innovate and provide premixes that align with these consumer demands. Consequently, the feed premix market is likely to expand as producers seek to meet these evolving consumer expectations.