Health and Wellness Trends

The growing focus on health and wellness among consumers is a significant driver for the instant beverage-premix market. As individuals become more health-conscious, there is a rising demand for beverages that offer functional benefits, such as added vitamins, minerals, and antioxidants. Recent surveys indicate that nearly 55% of consumers are willing to pay a premium for healthier beverage options. This trend encourages manufacturers within the instant beverage-premix market to reformulate existing products and develop new ones that align with health trends, thereby attracting a broader consumer base.

Innovative Product Offerings

Innovation plays a crucial role in the instant beverage-premix market, as manufacturers continuously develop new products to attract consumers. The introduction of unique flavors and formulations, such as plant-based and functional beverages, has expanded the market's reach. Recent statistics suggest that flavored instant beverages account for nearly 40% of total sales in the sector. This diversification not only caters to varying consumer preferences but also positions the instant beverage-premix market as a dynamic segment within the broader beverage landscape. Companies are investing in research and development to create products that align with emerging trends, thereby enhancing their competitive edge.

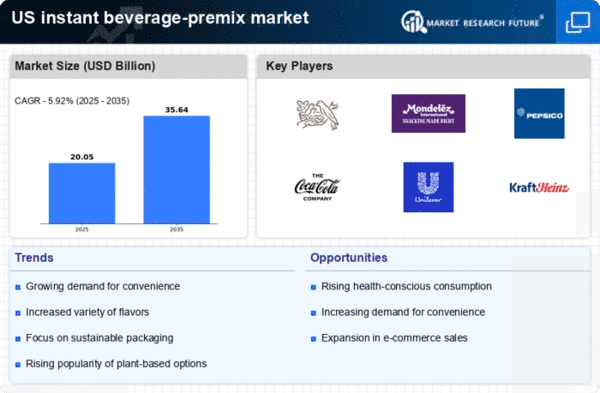

Rising Demand for Convenience

The instant beverage-premix market experiences a notable surge in demand driven by the increasing consumer preference for convenience. Busy lifestyles and the need for quick solutions have led to a significant rise in the consumption of instant beverages. According to recent data, the market is projected to grow at a CAGR of approximately 6.5% over the next five years. This trend indicates that consumers are seeking products that can be prepared rapidly without compromising on taste or quality. The instant beverage-premix market is adapting to this demand by offering a variety of options that cater to on-the-go consumption, thus enhancing its appeal among working professionals and students alike.

E-commerce Growth and Digital Marketing

The rise of e-commerce has significantly impacted the instant beverage-premix market, providing consumers with greater access to a wide range of products. Online sales channels have become increasingly popular, with a reported increase of 25% in online purchases of beverage premixes over the past year. This shift towards digital shopping is reshaping the market landscape, as brands leverage social media and targeted advertising to reach potential customers. The instant beverage-premix market is capitalizing on this trend by enhancing its online presence and offering exclusive promotions, which may lead to increased brand loyalty and consumer engagement.

Sustainability and Eco-Friendly Practices

Sustainability has emerged as a pivotal concern for consumers, influencing their purchasing decisions in the instant beverage-premix market. There is a growing expectation for brands to adopt eco-friendly practices, including sustainable sourcing of ingredients and environmentally friendly packaging. Recent data shows that 70% of consumers prefer brands that demonstrate a commitment to sustainability. This shift is prompting companies within the instant beverage-premix market to innovate in their production processes and packaging solutions, potentially enhancing their market appeal and aligning with consumer values.