Market Growth Projections

The Industrial Waste Management Industry is projected to experience substantial growth, with estimates indicating a market size of 981062.1 USD Billion in 2024 and a remarkable increase to 1305969.9 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 2.63% from 2025 to 2035. Such projections reflect the increasing demand for effective waste management solutions, including E-waste management, driven by regulatory pressures, technological advancements, and heightened sustainability awareness. The market's expansion underscores the critical role of Industrial Waste Management Market in supporting growth while addressing environmental concerns.

Growing Awareness of Sustainability

The growing awareness of sustainability among consumers and businesses is a crucial driver for the Industrial Waste Management Market . As stakeholders become more conscious of their environmental footprint, there is a rising demand for sustainable waste management practices. Companies are increasingly adopting circular economy principles, which emphasize reducing waste and reusing materials. This shift is evident in various sectors, including manufacturing and construction, where firms are implementing comprehensive plastic waste management strategies. The heightened focus on sustainability is likely to propel the market, contributing to its projected growth to 1305969.9 USD Billion by 2035.

Economic Growth and Industrialization

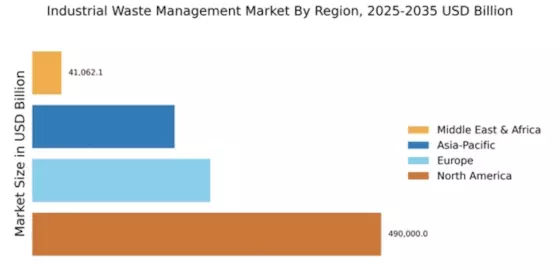

Economic growth and industrialization are significant factors influencing the Industrial Waste Management Market . As countries develop, industrial activities tend to increase, leading to higher volumes of waste generation. Emerging economies, in particular, are experiencing rapid industrialization, which necessitates effective Industrial Waste Management Market solutions. For instance, nations in Asia-Pacific are witnessing a surge in manufacturing activities, resulting in increased waste production. This trend underscores the need for robust waste management systems to mitigate environmental impacts. Consequently, the market is expected to expand, reflecting the correlation between industrial growth and waste management demands.

Investment in Waste Management Infrastructure

Investment in waste management infrastructure is a driving force in the Global Industrial Waste Management Industry. Governments and private sectors are recognizing the necessity of developing efficient waste management systems to handle increasing waste volumes. Initiatives such as building modern landfills, recycling facilities, and Industrial Waste Management Market plants are gaining traction globally. For example, the United States has allocated substantial funding for upgrading waste management infrastructure, aiming to enhance recycling rates and reduce landfill dependency. This focus on infrastructure development is likely to stimulate market growth, ensuring that waste management systems can keep pace with rising waste generation.

Technological Advancements in Waste Management

Technological advancements play a pivotal role in shaping the Industrial Waste Management Market. Innovations such as automated waste sorting systems, advanced recycling technologies, and waste-to-energy conversion processes are enhancing efficiency and effectiveness in waste management. For example, the integration of artificial intelligence in waste sorting has significantly improved the accuracy and speed of recycling operations. These technologies not only reduce operational costs but also minimize environmental impact, thereby aligning with global sustainability goals. As industries increasingly adopt these technologies, the market is anticipated to grow at a CAGR of 2.63% from 2025 to 2035.

Regulatory Compliance and Environmental Standards

The Industrial Waste Management Market is increasingly driven by stringent regulatory compliance and environmental standards. Governments worldwide are enacting laws that mandate proper waste disposal and management practices. For instance, the European Union's Waste Framework Directive emphasizes waste prevention and recycling, compelling industries to adopt sustainable waste management solutions. This regulatory landscape not only fosters environmental protection but also encourages innovation in Industrial Waste Management Market technologies. As a result, companies are investing in advanced waste treatment facilities, which is expected to contribute to the market's growth, projected to reach 981062.1 USD Billion in 2024.