Rising Labor Costs

The Industrial Robotics Market is significantly influenced by the rising labor costs observed in various regions. As wages continue to increase, particularly in developing economies, companies are compelled to seek cost-effective solutions to maintain profitability. The integration of industrial robots offers a viable alternative, allowing businesses to automate repetitive tasks and reduce reliance on manual labor. This shift not only mitigates the impact of labor cost inflation but also enhances operational efficiency. Data suggests that companies implementing robotic automation can achieve a return on investment within a few years, making it an attractive proposition in the current economic landscape. Consequently, the Industrial Robotics Market is poised for continued expansion as organizations prioritize automation to address labor challenges.

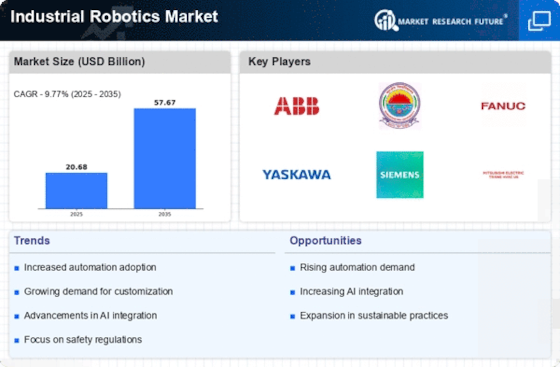

Increased Demand for Automation

The Industrial Robotics Industry experiences a notable surge in demand for automation across various sectors. Industries such as manufacturing, automotive, and electronics are increasingly adopting robotic solutions to enhance productivity and efficiency. According to recent data, the automation market is projected to grow at a compound annual growth rate (CAGR) of approximately 10% over the next five years. This trend indicates a strong inclination towards integrating robotics into production processes, thereby reducing labor costs and minimizing human error. As companies strive to remain competitive, the adoption of industrial robots becomes a strategic imperative, driving the growth of the Industrial Robotics Market.

Advancements in Robotics Technology

Technological advancements play a pivotal role in shaping the Industrial Robotics Market. Innovations in robotics, such as improved sensors, enhanced artificial intelligence, and sophisticated control systems, are enabling robots to perform complex tasks with greater precision and reliability. The introduction of collaborative robots, or cobots, is particularly noteworthy, as they are designed to work alongside human operators safely. This evolution in technology not only expands the capabilities of industrial robots but also makes them more accessible to small and medium-sized enterprises. As a result, the Industrial Robotics Market is likely to witness an influx of new applications and use cases, further propelling its growth.

Expansion of E-commerce and Logistics

The Industrial Robotics Industry is experiencing a transformative impact due to the expansion of e-commerce and logistics sectors. As online shopping continues to gain traction, the demand for efficient warehousing and distribution solutions has surged. Robotics technology is being leveraged to automate order fulfillment, inventory management, and shipping processes. Data indicates that the logistics automation market is expected to grow significantly, with a projected CAGR of over 15% in the coming years. This trend underscores the critical role of industrial robots in enhancing operational efficiency and meeting the increasing consumer expectations for rapid delivery. Consequently, the Industrial Robotics Market is likely to benefit from this burgeoning demand for automation in logistics.

Growing Focus on Quality and Precision

Quality control and precision are paramount in the Industrial Robotics Industry, particularly in sectors such as pharmaceuticals and aerospace. The demand for high-quality products necessitates the use of advanced robotic systems capable of performing intricate tasks with minimal deviation. Industrial robots equipped with state-of-the-art vision systems and feedback mechanisms ensure that products meet stringent quality standards. This emphasis on quality not only reduces waste and rework but also enhances customer satisfaction. As industries increasingly recognize the value of precision in manufacturing processes, the adoption of robotics is likely to accelerate, further driving the growth of the Industrial Robotics Market.