Emerging Markets and Economic Growth

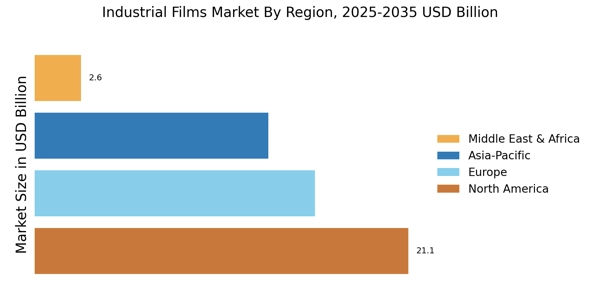

Emerging markets are becoming increasingly vital to the Industrial Films Market, driven by rapid economic growth and urbanization. Countries in Asia-Pacific, Latin America, and parts of Africa are witnessing a surge in industrial activities, leading to heightened demand for various industrial films. The construction, packaging, and automotive sectors in these regions are expanding, creating new opportunities for film manufacturers. By 2025, it is expected that these emerging markets will account for a significant share of the overall demand for industrial films, as local industries seek to enhance their production capabilities and meet international standards. This trend indicates a promising outlook for the Industrial Films Market in the coming years.

Rising Demand for Packaging Solutions

The Industrial Films Market experiences a notable surge in demand for innovative packaging solutions. This trend is primarily driven by the increasing need for efficient and sustainable packaging materials across various sectors, including food and beverage, pharmaceuticals, and consumer goods. As companies strive to enhance product shelf life and reduce waste, the adoption of advanced industrial films becomes essential. In 2025, the packaging segment is projected to account for a substantial share of the market, reflecting a shift towards eco-friendly materials. The emphasis on reducing plastic waste and improving recyclability further propels the growth of the Industrial Films Market, as manufacturers seek to align with consumer preferences for sustainable practices.

Growth in Automotive and Electronics Sectors

The Industrial Films Market is significantly influenced by the expansion of the automotive and electronics sectors. As these industries evolve, there is a growing need for high-performance films that offer protection, insulation, and aesthetic appeal. In 2025, the automotive sector is anticipated to contribute notably to the demand for industrial films, particularly in applications such as interior and exterior components. Similarly, the electronics industry seeks advanced films for use in displays, insulation, and packaging. This dual growth trajectory suggests a robust market potential, with the Industrial Films Market poised to benefit from the increasing integration of films in innovative product designs.

Regulatory Support for Sustainable Practices

Regulatory frameworks promoting sustainability are increasingly shaping the Industrial Films Market. Governments worldwide are implementing stringent regulations aimed at reducing plastic waste and encouraging the use of recyclable materials. This regulatory support fosters innovation in the development of biodegradable and compostable films, which are gaining traction among manufacturers. As companies adapt to these regulations, the demand for sustainable industrial films is likely to rise. In 2025, it is projected that the market for eco-friendly films will expand significantly, driven by both regulatory compliance and consumer demand for environmentally responsible products. This trend underscores the importance of sustainability in the future of the Industrial Films Market.

Technological Innovations in Film Production

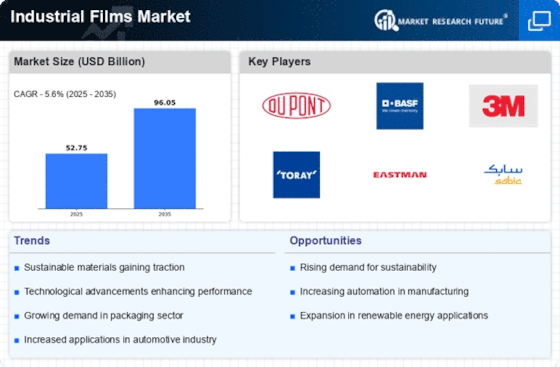

Technological advancements play a pivotal role in shaping the Industrial Films Market. Innovations in film production techniques, such as the development of high-performance polymers and advanced coating technologies, enhance the functionality and durability of industrial films. These innovations enable manufacturers to produce films that meet specific requirements, such as barrier properties, UV resistance, and thermal stability. As a result, industries such as automotive, electronics, and construction increasingly rely on these specialized films. The market is expected to witness a compound annual growth rate of approximately 5% from 2025 to 2030, driven by the continuous evolution of production technologies that cater to diverse industrial applications.