Top Industry Leaders in the Industrial Films Market

The industrial films market, a vast and diverse arena, is a crucial cog in the global industrial machine. Spanning applications from food packaging to construction, these versatile films fuel growth in various sectors. But this dynamism also translates to a fiercely competitive landscape, where established players and rising stars fight for market share.

Strategies that Shape the Game:

-

Innovation Prowess: Leading companies like Dow and ExxonMobil are constantly pushing the boundaries of film technology. From bio-based to self-healing films, the focus is on sustainability, performance enhancement, and catering to niche applications. -

Regional Focus: Asia Pacific, driven by rapid industrialization, dominates the market. Companies are strategically expanding their presence in these regions, building local production facilities and distribution networks. -

Diversification Playbook: Market leaders like DuPont are diversifying their product portfolios, venturing into new segments like high-performance films for the aerospace and medical industries. -

Strategic Partnerships and Acquisitions: Collaborations and mergers are common, allowing companies to access new technologies, expertise, and geographical reach. Recent examples include Berry Global's acquisition of Clopay Plastikfolien and Reifenhäuser's partnership with SABIC to develop sustainable film solutions.

Factors Defining Market Share:

-

Film Type: LLDPE films currently hold the largest market share due to their versatility and cost-effectiveness. However, demand for specialized films like BOPP and PET is growing, driven by specific application requirements. -

End-Use Industry: The agriculture sector is the fastest-growing, fueled by the need for greenhouse films and crop protection solutions. Packaging, construction, and transportation also remain significant drivers. -

Sustainability Focus: Environmental regulations and consumer preferences are propelling the demand for eco-friendly films made from recycled materials or biodegradable polymers. Companies like NatureWorks are capitalizing on this trend with their Ingeo bio-based films.

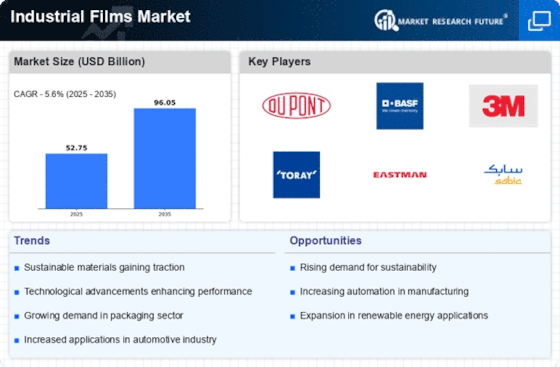

Key Players:

- TOYOBO Co. Ltd (Japan)

- DuPont de Nemours Inc. (US)

- TEKRA (US)

- MURAPLAST d.o.o. (Croatia)

- Transcendia (US)

- Mondi (Austria)

- Mitsui Chemicals Tohcello.Inc. (Japan)

- HiFi Industrial Films Limited (UK)

- Bogucki Folie (Lithuania)

- FUJIFILM Corporation (Japan)

- UNITIKA Ltd (Japan)

- Pely-plastic GmbH & Co. (Germany)

- LINTEC EUROPE (UK)

- Supreme mill stores (India)

- TAGHLEEF INDUSTRIES GROUP (Dubai)

Recent Developments:

July 2023: Mitsui Chemicals Tohcello Inc. expands its production capacity for BOPET films in Thailand, targeting the growing Southeast Asian market.

September 2023: Henkel launches a new adhesive specifically designed for industrial film applications, offering improved bonding strength and efficiency.

November 2023: A consortium of leading film producers forms the "Sustainable Industrial Films Alliance" to promote the development and adoption of eco-friendly film solutions.

December 2023: Eastman Chemical Company introduces a new line of bio-based adhesive tapes for industrial film applications, further boosting the sustainable offerings in the market.