Market Trends

Key Emerging Trends in the Industrial Catalysts Market

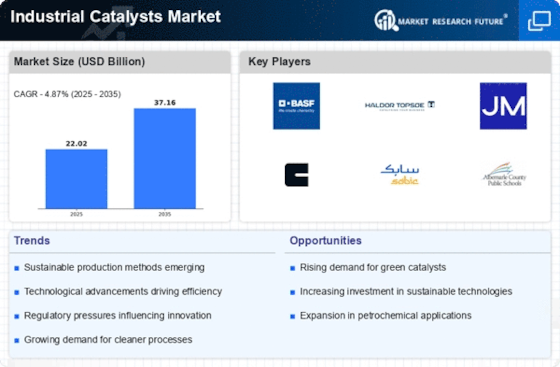

The Industrial Catalysts Market is witnessing notable trends and developments that are shaping its trajectory:

Technological Advancements: Continuous advancements in catalyst technology are driving market growth. Manufacturers are developing catalysts with enhanced efficiency, selectivity, and durability to meet the evolving needs of various industrial processes.

Focus on Sustainability: There is a growing emphasis on sustainable catalytic solutions to reduce environmental impact. Catalyst manufacturers are innovating to develop eco-friendly catalysts that minimize waste generation, energy consumption, and harmful emissions during chemical processes.

Rising Demand from End-Use Industries: The increasing demand for industrial catalysts from key end-use industries such as petroleum refining, chemical manufacturing, and environmental applications is fueling market growth. Rapid industrialization and urbanization worldwide are driving the need for catalysts to facilitate essential industrial processes.

Shift towards Heterogeneous Catalysts: There is a notable shift towards heterogeneous catalysts due to their advantages such as ease of separation, reusability, and compatibility with a wide range of reaction conditions. Heterogeneous catalysts are increasingly preferred over homogeneous catalysts in various industrial applications.

Growing Focus on Clean Energy Production: With the global push towards clean energy sources, there is an increasing demand for catalysts used in renewable energy production processes such as hydrogen fuel cell technology, biomass conversion, and carbon capture. Catalysts play a crucial role in enhancing the efficiency and sustainability of these processes.

Increasing Investment in Research and Development: Key players in the industrial catalysts market are ramping up their investment in research and development to innovate new catalyst formulations and improve existing ones. Collaborations between industry players, academic institutions, and research organizations are driving innovation in catalyst technology.

Stringent Regulatory Standards: Stringent environmental regulations and emission standards imposed by governments worldwide are driving the adoption of catalytic solutions to ensure compliance. Catalyst manufacturers are developing products that help industries meet regulatory requirements while minimizing environmental impact.

Focus on Petrochemical Industry: The petrochemical industry remains a significant consumer of industrial catalysts, particularly in processes such as catalytic cracking, reforming, and polymerization. As the demand for petrochemical products continues to rise, the need for efficient and cost-effective catalysts is expected to increase accordingly.

Market Expansion in Emerging Economies: Emerging economies in Asia-Pacific, Latin America, and Africa are witnessing significant growth in industrial catalysts consumption due to rapid industrialization and infrastructure development. Manufacturers are expanding their presence in these regions to capitalize on growing market opportunities.

Impact of COVID-19 Pandemic: The COVID-19 pandemic has impacted the industrial catalysts market, causing disruptions in supply chains and industrial operations. However, the market has shown resilience, with recovery observed in key sectors such as refining, chemicals, and environmental applications as economic activities resume.

Leave a Comment