Top Industry Leaders in the Industrial Catalysts Market

Industrial Catalysts Market

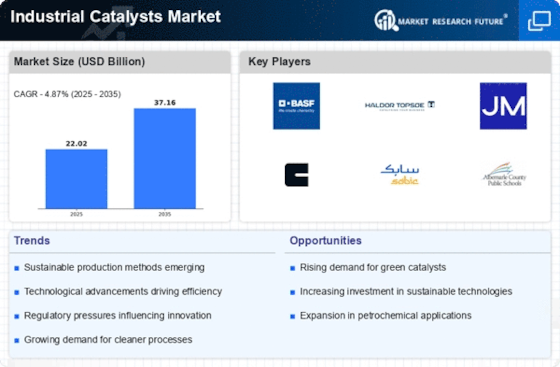

The industrial catalysts market, a critical cog in the wheel of global production, is a dynamic arena where innovation reigns supreme this market sees established players jostling with emerging disruptors, all vying for a bigger slice of the pie. Understanding the strategies adopted, factors impacting market share, and recent developments is crucial for navigating this competitive landscape.

Strategies Shaping the Market:

-

Product Diversification: Leading companies like BASF, Johnson Matthey, and UOP (Honeywell) are expanding their portfolios to cater to diverse applications across refining, petrochemicals, and specialty chemicals. This ensures a wider customer base and mitigates risk associated with sector-specific downturns. -

Focus on Sustainability: The burgeoning demand for green chemicals and emission reduction technologies is driving investments in catalysts for bio-based feedstocks and cleaner processes. Companies like Clariant and Evonik Industries are at the forefront of this shift, offering sustainable catalyst solutions for renewable energy production and biomass conversion. -

Technological Prowess: Continuous R&D efforts are vital to stay ahead of the curve. Players are investing heavily in developing high-performance catalysts with enhanced activity, selectivity, and durability. Advanced materials like zeolites and metal oxides are being explored to tailor catalysts for specific reactions, optimizing efficiency and reducing costs. -

Strategic Partnerships and Collaborations: Collaborations with universities, research institutions, and downstream users are becoming increasingly common. These partnerships foster knowledge sharing, accelerate innovation, and provide access to new markets and customer segments.

Factors Influencing Market Share:

-

Geographical Footprint: A strong global presence with regional production facilities and distribution networks is essential for capturing market share. Companies are expanding their reach in emerging economies like China, India, and Brazil, where the demand for industrial catalysts is booming. -

Brand Reputation: A trusted brand with a proven track record of quality and reliability holds immense value. Companies invest in building strong relationships with customers through technical support, training programs, and customized solutions. -

Pricing Strategies: Balancing competitive pricing with profitability is a delicate act. Cost optimization through efficient manufacturing processes and economies of scale allows players to offer competitive pricing without compromising quality. -

Regulatory Environment: Stringent environmental regulations are driving the development of cleaner and more efficient catalysts. Companies that adapt quickly to changing regulations and offer compliant solutions gain an edge over competitors.

Key Players

- Bayer AG (Germany)

- The Dow Chemical Company (US)

- Albemarle Corporation (US)

- BASF SE (Germany)

- Exxon Mobil Corporation (US)

- Akzo Nobel N.V. (the Netherlands)

- Chevron Phillips Chemical Company LLC (US)

- Clariant (Switzerland)

- Haldor Topsøe A/S (Denmark)

- INEOS (UK)

- Honeywell International Inc. (US)

Recent Developments:

-

September 2023: Evonik Industries acquires a leading manufacturer of zeolite catalysts, strengthening its position in the specialty chemicals market. -

October 2023: UOP (Honeywell) unveils a breakthrough catalyst technology for the production of hydrogen from natural gas, paving the way for cleaner fuel options. -

November 2023: China announces plans to invest $1 billion in the development of next-generation industrial catalysts, aiming to become a global leader in this technology. -

December 2023: The International Energy Agency (IEA) releases a report highlighting the critical role of industrial catalysts in achieving net-zero emissions targets, boosting investor confidence in the sector.