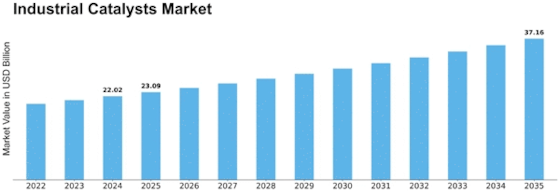

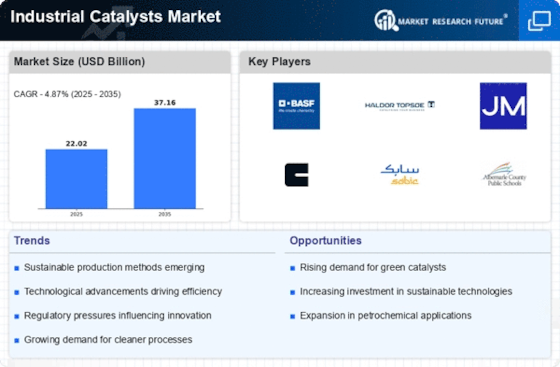

Industrial Catalysts Size

Industrial Catalysts Market Growth Projections and Opportunities

Market Factors of Industrial Catalysts Market:

Industry Growth: The industrial catalysts market is witnessing significant growth due to the expanding industrial sector globally, driven by increased manufacturing activities across various industries such as petrochemicals, chemicals, automotive, and pharmaceuticals.

Demand for Petrochemicals: The petrochemical industry is a major consumer of industrial catalysts, utilizing them in various processes such as catalytic cracking, catalytic reforming, and hydroprocessing to convert raw materials like crude oil and natural gas into valuable products like gasoline, diesel, and petrochemical intermediates.

Chemical Manufacturing: Industrial catalysts play a crucial role in chemical manufacturing processes, facilitating reactions to produce a wide range of chemicals and intermediates used in industries such as fertilizers, plastics, polymers, and specialty chemicals.

Environmental Regulations: Stringent environmental regulations mandating the use of catalysts to minimize emissions and pollutants in industrial processes drive the demand for environmental catalysts, particularly in industries such as automotive and power generation, where catalytic converters are used to reduce harmful emissions from vehicles and power plants.

Technological Advancements: Continuous advancements in catalyst technology, such as the development of novel catalyst formulations and structures, enable improved process efficiency, selectivity, and sustainability, driving their adoption across various industries.

Energy Sector Demand: The energy sector utilizes industrial catalysts in refining crude oil into petroleum products, as well as in the production of clean fuels and renewable energy sources like biofuels and hydrogen, contributing to the market growth.

Automotive Industry Influence: The automotive industry's demand for catalytic converters to comply with emission standards and regulations, coupled with the growing production of vehicles worldwide, fuels the demand for industrial catalysts.

Shift towards Sustainable Practices: Increasing emphasis on sustainability and green chemistry practices encourages industries to adopt catalytic processes that minimize waste generation, energy consumption, and environmental impact, thereby driving the demand for sustainable industrial catalysts.

Regional Market Dynamics: Market dynamics vary across regions, influenced by factors such as economic development, industrialization pace, regulatory environment, and availability of raw materials. Emerging economies exhibit high growth potential due to rapid industrialization and infrastructure development.

Research and Development Initiatives: Ongoing research and development activities focus on the development of novel catalyst materials and formulations with enhanced performance, stability, and selectivity, catering to evolving industry requirements and addressing environmental challenges.

Market Competition and Consolidation: The industrial catalysts market is highly competitive, with key players striving to expand their product portfolios, enhance market presence, and gain a competitive edge through strategies such as mergers, acquisitions, and partnerships.

Cost and Pricing Dynamics: Fluctuations in the prices of raw materials, particularly metals and rare earth elements used in catalyst formulations, impact production costs and pricing strategies of industrial catalysts, influencing market dynamics.

COVID-19 Impact: The COVID-19 pandemic initially caused disruptions in supply chains and manufacturing activities, affecting the industrial catalysts market. However, as economic activities resume and industries recover, the demand for catalysts is expected to rebound, driven by the need to optimize production processes and comply with regulatory requirements.

Long-term Growth Outlook: Despite short-term challenges, the industrial catalysts market exhibits promising long-term growth prospects, supported by increasing industrialization, technological advancements, regulatory compliance requirements, and the shift towards sustainable practices across industries.

Consumer Trends and Preferences: Changing consumer preferences towards environmentally friendly products and processes influence industry practices and drive the adoption of catalytic technologies that enable cleaner and more sustainable manufacturing processes.

Leave a Comment