Emergence of PropTech Startups

The emergence of PropTech startups in India significantly influences the real estate-software market. These startups leverage technology to address various challenges in the real estate sector, offering innovative solutions that enhance efficiency and user experience. With a growing number of investors recognizing the potential of PropTech, funding for these startups has surged, leading to the development of diverse software applications. In 2025, it is projected that investment in PropTech could reach $1 billion, reflecting the increasing interest in technology-driven solutions. As these startups introduce disruptive technologies, traditional real estate firms are compelled to adopt software solutions that enhance their competitiveness and operational efficiency, thereby driving growth in the overall market.

Increased Focus on Data Analytics

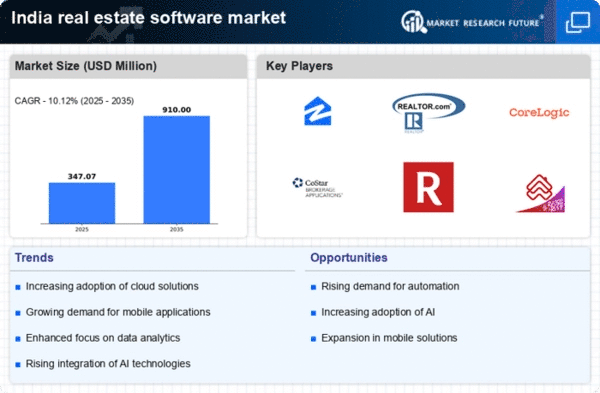

The real estate-software market in India is witnessing a heightened focus on data analytics as stakeholders seek to make informed decisions. The ability to analyze market trends, consumer behavior, and property valuations through software tools is becoming increasingly valuable. Real estate firms are investing in software that incorporates advanced analytics capabilities to gain insights into market dynamics and optimize their strategies. In 2025, it is anticipated that over 40% of real estate companies will utilize data analytics tools to enhance their decision-making processes. This trend not only improves operational efficiency but also enables firms to tailor their offerings to meet the evolving needs of consumers, thereby fostering growth in the real estate-software market.

Government Initiatives and Regulations

Government policies and initiatives play a pivotal role in shaping the real estate-software market in India. The introduction of regulations aimed at promoting transparency and accountability in real estate transactions has led to an increased reliance on software solutions. For instance, the Real Estate (Regulation and Development) Act, 2016, mandates the registration of real estate projects, which necessitates the use of software for compliance and reporting. Furthermore, initiatives such as the Digital India campaign encourage the adoption of technology in various sectors, including real estate. As a result, software that aids in regulatory compliance and project management is likely to witness significant growth, aligning with the government's vision for a more organized real estate market.

Rising Demand for Digital Transactions

The real estate-software market in India experiences a notable surge in demand for digital transaction solutions. As consumers increasingly prefer online platforms for property transactions, software that facilitates secure and efficient digital payments becomes essential. In 2025, it is estimated that over 60% of real estate transactions in urban areas will be conducted digitally. This shift not only enhances convenience for buyers and sellers but also streamlines processes for real estate agents and developers. Consequently, software solutions that integrate payment gateways and transaction management features are likely to see heightened adoption. The growing emphasis on transparency and security in transactions further propels the demand for sophisticated software solutions in the real estate sector.

Urbanization and Infrastructure Development

Rapid urbanization in India is a driving force behind the growth of the real estate-software market. With an increasing population migrating to urban areas, the demand for housing and commercial spaces is on the rise. According to estimates, urban areas are expected to account for nearly 60% of India's population by 2031. This demographic shift necessitates efficient planning and management of real estate projects, which can be facilitated through advanced software solutions. Additionally, ongoing infrastructure development projects, such as smart cities and transportation networks, create opportunities for software that supports project management, land acquisition, and stakeholder collaboration. The convergence of urbanization and infrastructure initiatives is likely to propel the demand for innovative software solutions in the real estate sector.