Rising Demand for Automation

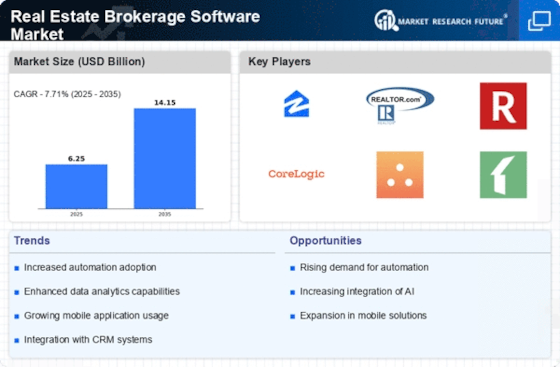

The Real Estate Brokerage Software Market experiences a notable surge in demand for automation tools. As real estate transactions become increasingly complex, brokers seek software solutions that streamline operations, reduce manual tasks, and enhance efficiency. Automation features such as transaction management, document generation, and client communication tools are becoming essential. According to recent data, the market for automation in real estate is projected to grow at a compound annual growth rate of 10% over the next five years. This trend indicates that brokers are prioritizing software that can automate repetitive tasks, allowing them to focus on client relationships and strategic decision-making.

Integration of Mobile Technology

The Real Estate Brokerage Software Market is witnessing a significant shift towards mobile technology integration. As mobile devices become ubiquitous, brokers are increasingly relying on mobile applications to manage their operations on-the-go. This trend allows agents to access property listings, communicate with clients, and manage transactions from anywhere, enhancing flexibility and responsiveness. Recent statistics indicate that over 60% of real estate professionals now utilize mobile apps as part of their daily operations. This shift underscores the necessity for brokerage software to offer mobile-friendly solutions, catering to the evolving needs of agents and clients alike.

Shift Towards Remote Work Solutions

The Real Estate Brokerage Software Market is adapting to the shift towards remote work solutions. As more professionals embrace flexible work arrangements, brokerage software that supports remote collaboration and communication is becoming increasingly vital. Features such as virtual meetings, cloud storage, and collaborative tools are essential for maintaining productivity in a remote environment. Recent surveys indicate that nearly 70% of real estate agents prefer software that facilitates remote work capabilities. This trend highlights the necessity for brokerage software to evolve, ensuring that agents can effectively operate and collaborate regardless of their physical location.

Growing Importance of Data Analytics

Data analytics is emerging as a critical driver in the Real Estate Brokerage Software Market. Brokers are increasingly leveraging data to make informed decisions regarding pricing, marketing strategies, and client targeting. Advanced analytics tools enable brokers to analyze market trends, assess property values, and identify potential investment opportunities. The market for data analytics in real estate is expected to expand significantly, with projections indicating a growth rate of 12% annually. This trend suggests that brokerage software must incorporate sophisticated analytics capabilities to empower brokers with actionable insights, enhancing their competitive edge.

Enhanced Customer Relationship Management

In the Real Estate Brokerage Software Market, the emphasis on customer relationship management (CRM) systems is intensifying. Brokers recognize the importance of maintaining strong relationships with clients to foster loyalty and repeat business. Advanced CRM features, including lead tracking, personalized communication, and performance analytics, are increasingly integrated into brokerage software. Data suggests that companies utilizing robust CRM systems can see a 30% increase in client retention rates. This trend highlights the necessity for brokers to adopt software that not only manages transactions but also nurtures client relationships, ultimately driving growth in the competitive real estate landscape.