Emergence of Industry-Specific Solutions

The The private LTE market in India. is evolving with the emergence of industry-specific solutions tailored to meet the unique needs of various sectors. As organizations seek to address specific challenges, such as security, scalability, and reliability, private lte networks are being customized to provide targeted functionalities. For instance, the manufacturing sector may require solutions that support machine-to-machine communication, while the healthcare sector may prioritize secure patient data transmission. This trend towards specialization is likely to drive innovation within the private lte market, as vendors develop tailored offerings that cater to the distinct requirements of different industries. The ability to provide customized solutions is expected to enhance the attractiveness of private lte networks, thereby fostering greater adoption across diverse sectors.

Growing Demand for Reliable Connectivity

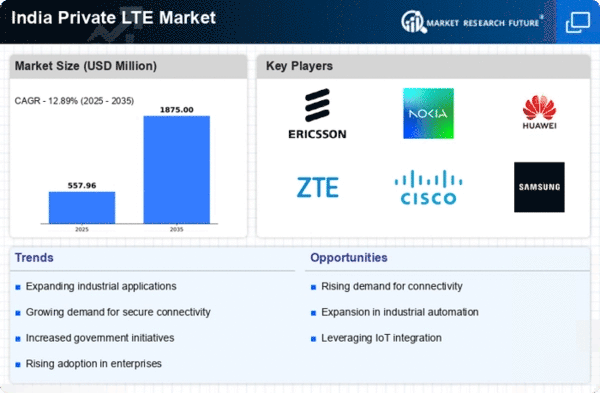

The The private LTE market in India. is experiencing a surge in demand for reliable connectivity solutions across various sectors. Industries such as manufacturing, logistics, and energy are increasingly recognizing the need for dedicated networks that ensure uninterrupted communication. This demand is driven by the necessity for real-time data transmission and operational efficiency. According to recent estimates, the private lte market is projected to grow at a CAGR of approximately 15% over the next five years. This growth is indicative of the market's potential to support critical applications, such as remote monitoring and automation, which are essential for maintaining competitive advantage in today's fast-paced environment. As organizations seek to enhance their operational capabilities, the private lte market is likely to play a pivotal role in facilitating this transformation.

Regulatory Support and Policy Frameworks

The The private LTE market in India. is significantly influenced by the evolving regulatory landscape and supportive policy frameworks. The Indian government has been actively promoting the adoption of private networks to enhance digital infrastructure and connectivity. Initiatives such as the National Digital Communications Policy aim to foster innovation and investment in telecommunications. Furthermore, the allocation of spectrum for private networks is expected to provide a conducive environment for growth. This regulatory support is crucial for industries that require customized communication solutions, as it enables them to deploy private lte networks tailored to their specific needs. The alignment of government policies with market demands is likely to accelerate the adoption of private lte solutions across various sectors.

Increased Focus on Operational Efficiency

In the context of the private lte market, organizations in India are increasingly prioritizing operational efficiency as a key driver for adopting dedicated networks. The ability to streamline processes, reduce downtime, and enhance productivity is becoming paramount for businesses across sectors. Private lte networks offer the advantage of low latency and high reliability, which are essential for applications such as automation and IoT integration. As companies seek to optimize their operations, the private lte market is positioned to provide the necessary infrastructure to support these initiatives. Industry reports suggest that organizations leveraging private lte solutions can achieve operational cost savings of up to 20%, further incentivizing the shift towards dedicated communication networks.

Rising Investment in Digital Transformation

The The The private LTE market in India.. is witnessing a notable increase in investment as organizations embark on digital transformation journeys. Companies are recognizing the importance of robust communication networks to support advanced technologies such as AI, IoT, and big data analytics. This trend is particularly evident in sectors like healthcare and manufacturing, where the integration of digital solutions is critical for enhancing service delivery and operational capabilities. The private lte market is expected to benefit from this influx of investment, as businesses seek to establish secure and efficient communication channels. Analysts project that the market could see investments exceeding $1 billion by 2026, reflecting the growing recognition of private lte networks as foundational elements of digital infrastructure.