Growing Geriatric Population

The increasing geriatric population in India is a crucial driver for the percutaneous coronary-intervention market. As individuals age, the risk of developing cardiovascular diseases escalates, necessitating effective treatment options. By 2030, it is estimated that the elderly population in India will exceed 300 million, creating a substantial demand for healthcare services, including percutaneous coronary interventions. This demographic shift is prompting healthcare providers to enhance their capabilities in managing age-related health issues. Consequently, the percutaneous coronary-intervention market is likely to expand as more elderly patients seek timely interventions to address their cardiovascular conditions. Additionally, the focus on geriatric care is expected to lead to increased investments in healthcare infrastructure, further supporting market growth.

Advancements in Medical Technology

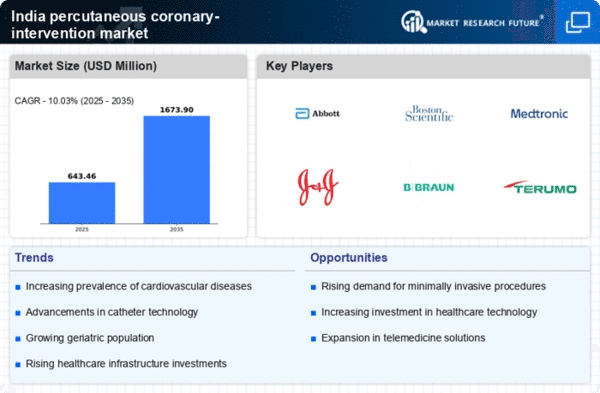

Technological advancements in medical devices and techniques are propelling the percutaneous coronary-intervention market forward. Innovations such as drug-eluting stents, bioresorbable stents, and advanced imaging techniques have improved the efficacy and safety of these procedures. In India, the adoption of these technologies is becoming more widespread, as healthcare providers seek to enhance patient outcomes. The market for coronary stents alone is projected to reach approximately $1.5 billion by 2026, reflecting the growing reliance on advanced interventions. Furthermore, the integration of telemedicine and remote monitoring technologies is likely to facilitate better patient management post-procedure, thereby increasing the attractiveness of percutaneous coronary interventions. This trend suggests a robust future for the market as technology continues to evolve.

Rising Health Insurance Penetration

The increasing penetration of health insurance in India is positively impacting the percutaneous coronary-intervention market. As more individuals gain access to health insurance coverage, the financial burden of medical procedures, including percutaneous coronary interventions, is alleviated. This trend is particularly relevant in urban areas, where health insurance adoption is on the rise. Reports indicate that health insurance coverage in India has grown to approximately 40% of the population, which is likely to increase further. With improved financial accessibility, patients are more inclined to seek necessary interventions for cardiovascular diseases. This shift not only enhances patient outcomes but also stimulates growth in the percutaneous coronary-intervention market, as healthcare providers respond to the rising demand for these essential services.

Government Initiatives and Healthcare Policies

Government initiatives aimed at enhancing healthcare infrastructure and accessibility are significantly influencing the percutaneous coronary-intervention market. The Indian government has launched various schemes to improve healthcare delivery, including the Ayushman Bharat scheme, which aims to provide health insurance to millions of citizens. Such policies are likely to increase the number of patients seeking treatment for cardiovascular diseases, thereby driving demand for percutaneous coronary interventions. Additionally, investments in healthcare facilities and training for medical professionals are expected to improve the quality of care. As a result, the percutaneous coronary-intervention market is poised for growth, with more hospitals equipped to perform these procedures and a larger patient base able to afford them.

Increasing Incidence of Cardiovascular Diseases

The rising incidence of cardiovascular diseases in India is a primary driver for the percutaneous coronary-intervention market. According to recent health reports, cardiovascular diseases account for approximately 28% of all deaths in the country. This alarming statistic highlights the urgent need for effective treatment options, including percutaneous coronary interventions. As the population ages and lifestyle-related health issues become more prevalent, the demand for these minimally invasive procedures is expected to grow. Hospitals and healthcare providers are increasingly adopting advanced technologies to address this growing health crisis, thereby expanding the percutaneous coronary-intervention market. Furthermore, the Indian government's initiatives to improve healthcare access and affordability may further bolster the market, as more patients seek timely interventions to manage their cardiovascular health.