Rising Healthcare Expenditure

The increase in healthcare expenditure in the UK is a significant driver for the percutaneous coronary-intervention market. With the government and private sectors investing more in healthcare infrastructure and technology, there is a greater availability of resources for advanced cardiac care. Recent reports indicate that healthcare spending in the UK has risen by approximately 5% annually, with a substantial portion allocated to cardiovascular treatments. This financial commitment is likely to enhance the accessibility and quality of percutaneous interventions, thereby stimulating market growth. As funding continues to improve, the percutaneous coronary-intervention market is expected to benefit from enhanced service delivery and patient outcomes.

Growing Focus on Preventive Healthcare

The increasing emphasis on preventive healthcare measures in the UK is influencing the percutaneous coronary-intervention market. As healthcare policies shift towards prevention and early intervention, there is a heightened awareness of cardiovascular health among the population. Initiatives aimed at educating the public about heart health and the importance of regular screenings are likely to lead to earlier diagnoses and timely interventions. This proactive approach may result in a higher demand for percutaneous procedures as patients seek to manage their cardiovascular risks effectively. Consequently, the percutaneous coronary-intervention market is poised for growth as preventive strategies become more ingrained in healthcare practices.

Advancements in Medical Imaging Technologies

Innovations in medical imaging technologies are playing a pivotal role in enhancing the precision and outcomes of percutaneous coronary interventions. Techniques such as intravascular ultrasound (IVUS) and optical coherence tomography (OCT) are becoming increasingly integrated into clinical practice in the UK. These advancements allow for better visualization of coronary anatomy, leading to improved decision-making during procedures. The integration of these technologies is expected to drive growth in the percutaneous coronary-intervention market, as they contribute to higher success rates and reduced complications. As healthcare providers continue to invest in advanced imaging solutions, the market is likely to witness a significant uptick in procedural volumes.

Aging Population and Associated Health Risks

The demographic shift towards an aging population in the UK is a critical driver for the percutaneous coronary-intervention market. As individuals age, the prevalence of cardiovascular diseases tends to increase, necessitating more frequent interventions. Current statistics indicate that approximately 40% of individuals over 65 years old experience some form of cardiovascular condition. This demographic trend suggests a sustained demand for percutaneous interventions, as healthcare systems adapt to the needs of older patients. Consequently, the percutaneous coronary-intervention market is likely to expand in response to the growing number of elderly patients requiring treatment, thereby shaping the future landscape of cardiovascular care.

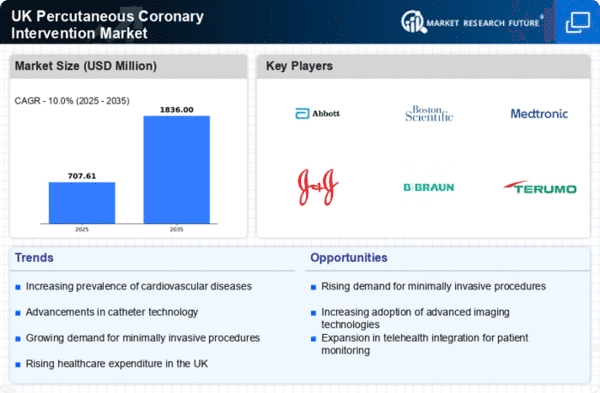

Increasing Demand for Minimally Invasive Procedures

The percutaneous coronary-intervention market is experiencing a notable shift towards minimally invasive procedures, driven by patient preference for reduced recovery times and lower complication rates. As healthcare providers in the UK increasingly adopt these techniques, the market is projected to grow significantly. According to recent data, minimally invasive cardiac procedures have shown a 30% increase in adoption over the past five years. This trend is likely to continue as advancements in technology enhance the safety and efficacy of these interventions. Furthermore, the growing awareness among patients regarding the benefits of such procedures is expected to further fuel demand, thereby positively impacting the percutaneous coronary-intervention market.