Integration with Smart Devices

The proliferation of smart devices in India is significantly influencing the palm recognition market. As smartphones, tablets, and wearables increasingly incorporate biometric authentication features, the demand for palm recognition technology is expected to rise. The market is anticipated to reach a valuation of $500 million by 2027, driven by consumer preference for seamless and secure access to their devices. This integration not only enhances user experience but also promotes the adoption of palm recognition in various applications, including mobile payments and personal identification, thereby expanding the market's reach.

Rising Adoption in Healthcare Sector

The healthcare sector in India is increasingly adopting palm recognition technology to streamline patient identification and enhance security. Hospitals and clinics are implementing biometric systems to reduce fraud and improve patient data management. The palm recognition market is projected to capture a significant share of the healthcare technology market, which is expected to grow to $370 billion by 2030. This trend indicates a growing recognition of the benefits of biometric solutions in improving operational efficiency and patient safety, thereby driving the palm recognition market forward.

Increased Focus on Contactless Solutions

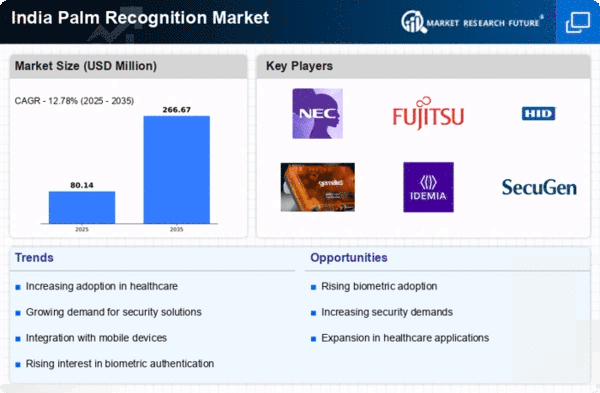

The shift towards contactless solutions in various industries is propelling the palm recognition market in India. As businesses seek to minimize physical contact due to hygiene concerns, palm recognition technology offers a non-invasive and efficient alternative for authentication. This trend is particularly relevant in sectors such as retail and banking, where customer experience and safety are paramount. The palm recognition market is likely to see a surge in demand as organizations prioritize contactless interactions, potentially leading to a market growth rate aligned with the projected CAGR of 12.78%.

Government Initiatives for Digital Identity

The Indian government's push for digital identity solutions is a crucial driver for the palm recognition market. Initiatives such as the Digital India program aim to provide citizens with secure and efficient access to services. These initiatives are likely to benefit the palm recognition market, as biometric systems are integral to the government's vision of a digitally empowered society. With an estimated investment of $1 billion in biometric technologies, the government is fostering an environment conducive to the growth of the palm recognition market, enhancing its adoption across public services and private sectors.

Growing Demand for Biometric Security Solutions

The increasing need for enhanced security measures across various sectors is driving the growth of the palm recognition market in India. With rising concerns over data breaches and identity theft, organizations are seeking reliable biometric solutions. The palm recognition market is projected to grow at a CAGR of approximately 12.78% from 2025 to 2035. This growth is fueled by the adoption of palm recognition technology in banking, healthcare, and government sectors, where secure access to sensitive information is paramount. As businesses and institutions prioritize security, the demand for advanced biometric systems, including palm recognition, is likely to escalate, indicating a robust market trajectory.