Growing Geriatric Population

The demographic shift towards an aging population in India is a crucial driver for the India Intraocular Lens Market. As the geriatric population continues to expand, the prevalence of age-related eye conditions, particularly cataracts, is expected to rise significantly. Current estimates suggest that by 2030, the number of individuals aged 60 and above in India will exceed 300 million, creating a substantial demand for cataract surgeries and intraocular lenses. This demographic trend is likely to compel healthcare providers to enhance their service offerings, including the availability of advanced intraocular lenses. Consequently, the India Intraocular Lens Market is poised for robust growth as it adapts to meet the needs of this expanding patient demographic.

Increase in Healthcare Expenditure

The India Intraocular Lens Market is benefiting from the overall increase in healthcare expenditure within the country. With the government and private sectors investing more in healthcare infrastructure, there is a notable rise in the availability of advanced medical technologies, including intraocular lenses. Recent data indicates that healthcare spending in India is projected to reach USD 372 billion by 2022, reflecting a growing commitment to improving healthcare services. This increase in expenditure is likely to facilitate the adoption of innovative intraocular lens technologies, making them more accessible to a broader patient population. As a result, the India Intraocular Lens Market is expected to experience significant growth, driven by enhanced healthcare facilities and improved patient access to quality eye care.

Government Initiatives for Eye Health

The India Intraocular Lens Market is significantly influenced by various government initiatives aimed at improving eye health across the nation. Programs such as the National Programme for Control of Blindness and Visual Impairment (NPCBVI) have been instrumental in raising awareness about cataract surgeries and the importance of intraocular lenses. The government has also been promoting affordable eye care services, which has led to an increase in the number of eye hospitals and clinics offering intraocular lens implantation. Recent statistics indicate that the number of cataract surgeries performed annually in India has reached over 6 million, with a substantial portion utilizing intraocular lenses. This proactive approach by the government is likely to enhance accessibility and affordability, thereby stimulating growth in the India Intraocular Lens Market.

Rising Patient Awareness and Education

The India Intraocular Lens Market is witnessing a surge in demand driven by rising patient awareness and education regarding eye health. Increased access to information through digital platforms and social media has empowered patients to seek timely medical intervention for eye-related issues. Educational campaigns focusing on the benefits of intraocular lenses, particularly in cataract surgeries, have contributed to a more informed patient base. Recent surveys indicate that approximately 70% of patients are now aware of the options available for cataract treatment, including the use of intraocular lenses. This heightened awareness is likely to lead to an increase in elective surgeries, thereby positively impacting the growth trajectory of the India Intraocular Lens Market.

Technological Advancements in Lens Design

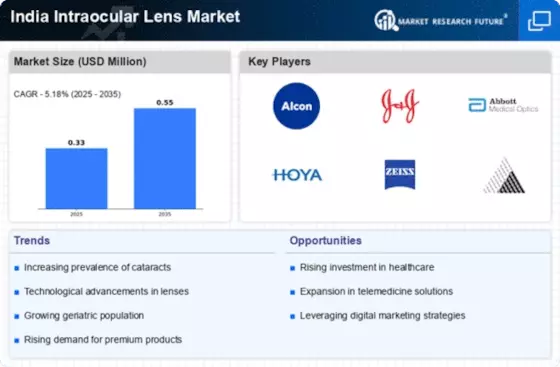

The India Intraocular Lens Market is experiencing a transformative phase due to rapid technological advancements in lens design. Innovations such as multifocal and toric lenses are gaining traction, catering to the diverse needs of patients with varying degrees of refractive errors. The introduction of premium lenses, which offer enhanced visual outcomes, is likely to drive market growth. According to recent data, the market for advanced intraocular lenses is projected to grow at a compound annual growth rate (CAGR) of approximately 10% over the next five years. This growth is attributed to the increasing adoption of minimally invasive surgical techniques and the rising prevalence of cataracts among the aging population in India. As a result, the demand for high-quality intraocular lenses is expected to surge, further propelling the India Intraocular Lens Market.