Government Initiatives and Funding

The UK Intraocular Lens Market benefits from various government initiatives aimed at improving eye health services. The NHS has allocated substantial funding to enhance cataract surgery services, which directly impacts the demand for intraocular lenses. Recent policies have focused on reducing waiting times for surgeries, thereby increasing the number of procedures performed annually. Additionally, the UK government has been promoting awareness campaigns about eye health, encouraging individuals to seek timely treatment for vision-related issues. These initiatives not only support the growth of the UK Intraocular Lens Market but also ensure that patients have access to the latest lens technologies, ultimately improving patient outcomes.

Rising Prevalence of Eye Disorders

The UK Intraocular Lens Market is significantly influenced by the rising prevalence of eye disorders, particularly cataracts and age-related macular degeneration. According to recent statistics, cataracts affect nearly 50% of individuals over the age of 65 in the UK, leading to an increased demand for surgical interventions and intraocular lenses. This growing patient population necessitates the availability of diverse lens options to cater to varying visual needs. Furthermore, the National Health Service (NHS) has been actively promoting cataract surgeries, which further propels the demand for intraocular lenses. As the population ages, the UK Intraocular Lens Market is expected to expand, with an increasing number of patients seeking surgical solutions to restore their vision.

Increasing Awareness of Vision Health

The UK Intraocular Lens Market is witnessing a rise in awareness regarding vision health, which is driving demand for intraocular lenses. Public health campaigns and educational programs have been instrumental in informing the population about the importance of regular eye examinations and the available treatment options for vision impairment. As individuals become more proactive about their eye health, the demand for cataract surgeries and, consequently, intraocular lenses is expected to rise. This trend is particularly evident among the aging population, who are increasingly seeking solutions to maintain their quality of life. The UK Intraocular Lens Market is likely to benefit from this heightened awareness, leading to an increase in the number of patients opting for lens implantation.

Growth of the Private Healthcare Sector

The UK Intraocular Lens Market is also influenced by the growth of the private healthcare sector, which offers patients more options for cataract surgery and lens selection. With an increasing number of private clinics providing advanced surgical techniques and premium intraocular lenses, patients are more inclined to seek private care for their eye conditions. This trend is supported by the rising disposable income among the population, allowing individuals to invest in their eye health. The private sector's expansion is likely to create a competitive environment, driving innovation and improving the quality of intraocular lenses available in the UK Intraocular Lens Market. As a result, the market is expected to grow as more patients choose private healthcare solutions.

Technological Innovations in Intraocular Lenses

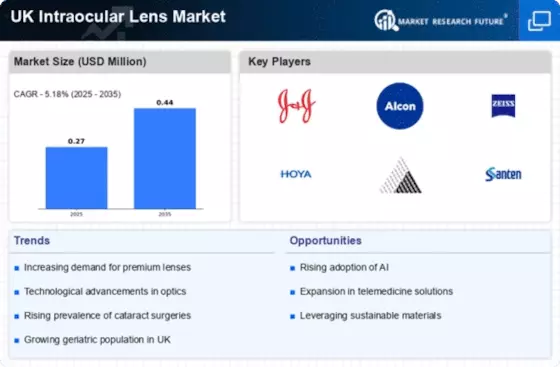

The UK Intraocular Lens Market is experiencing a surge in technological innovations that enhance the performance and safety of intraocular lenses. Advanced materials and designs, such as hydrophobic acrylic and multifocal lenses, are becoming increasingly prevalent. These innovations not only improve visual outcomes but also reduce the risk of complications. For instance, the introduction of toric lenses has significantly benefited patients with astigmatism, leading to a higher adoption rate among ophthalmologists. The market is projected to grow at a compound annual growth rate (CAGR) of approximately 5% over the next five years, driven by these advancements. As a result, the UK Intraocular Lens Market is likely to witness a shift towards premium products that offer enhanced features and patient satisfaction.