Rising Energy Demand

The hydropower market in India is experiencing a surge in demand for energy, driven by rapid urbanization and industrial growth. As the population continues to expand, the need for reliable and sustainable energy sources becomes increasingly critical. The Indian government has set ambitious targets to increase the share of renewable energy in the overall energy mix, aiming for 500 GW of renewable capacity by 2030. This push is likely to enhance the role of hydropower, which currently contributes around 12 % of the total installed capacity. The hydropower market is thus positioned to benefit from this rising energy demand, as it offers a stable and renewable solution to meet the country's growing needs.

Investment Opportunities

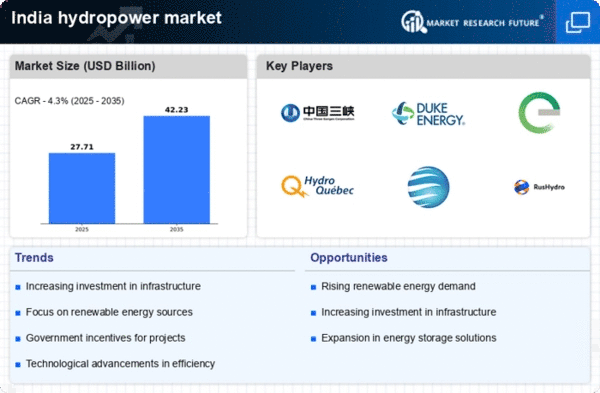

The hydropower market in India presents numerous investment opportunities, particularly in the context of infrastructure development. With the government's focus on expanding renewable energy capacity, private investors are increasingly looking towards hydropower as a viable option. The estimated investment required to achieve the 60 GW target by 2030 is around $15 billion. This potential for high returns, coupled with the stability of hydropower as a long-term energy source, makes it an attractive proposition for investors. Furthermore, public-private partnerships are likely to play a crucial role in financing new projects, thereby stimulating growth in the hydropower market.

Government Policy Support

Government initiatives play a pivotal role in shaping the hydropower market in India. Policies aimed at promoting renewable energy, such as the National Hydropower Policy, provide a framework for investment and development. The government has introduced various incentives, including financial support and streamlined regulatory processes, to encourage private sector participation. As of 2025, the government aims to increase hydropower capacity to 60 GW, which represents a significant opportunity for stakeholders in the hydropower market. This supportive policy environment is likely to attract both domestic and foreign investments, fostering growth and innovation within the sector.

Technological Innovations

Technological advancements are transforming the hydropower market in India. Innovations in turbine design, automation, and grid integration are enhancing the efficiency and reliability of hydropower plants. The adoption of smart grid technologies allows for better management of energy distribution, optimizing the use of hydropower resources. As of 2025, the integration of digital technologies is expected to improve operational efficiency by up to 20 %. These innovations not only reduce operational costs but also increase the competitiveness of hydropower against other energy sources. Consequently, the hydropower market is likely to see a surge in new projects and upgrades to existing facilities.

Environmental Considerations

The hydropower market in India is increasingly influenced by environmental considerations. As climate change concerns rise, there is a growing emphasis on sustainable energy sources. Hydropower, being a renewable resource, is viewed as a viable alternative to fossil fuels. The Indian government has committed to reducing carbon emissions by 33-35 % by 2030, which aligns with the expansion of hydropower projects. Additionally, the hydropower market is expected to benefit from advancements in eco-friendly technologies that minimize ecological impacts. This focus on environmental sustainability is likely to drive investments and development in the hydropower sector.