Increasing Demand for Renewable Energy

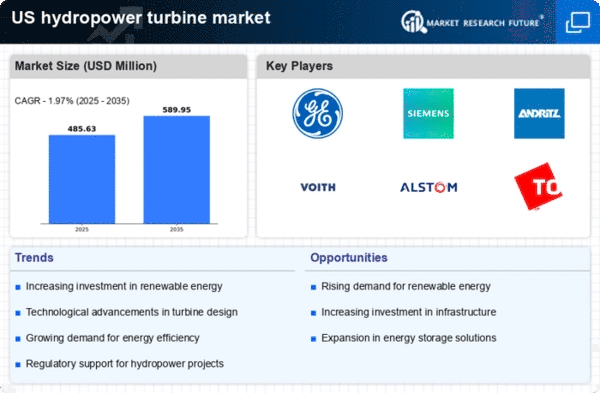

The hydropower turbine market is experiencing a notable surge in demand driven by the growing emphasis on renewable energy sources. As the U.S. government aims to achieve a 50% reduction in greenhouse gas emissions by 2030, hydropower is positioned as a key player in this transition. The market is projected to grow at a CAGR of approximately 3.5% from 2025 to 2030, reflecting the increasing investments in renewable energy infrastructure. This shift towards cleaner energy sources is likely to bolster the hydropower turbine market, as utilities and private investors seek sustainable solutions to meet energy needs while adhering to environmental regulations.

Environmental Regulations and Compliance

Stringent environmental regulations are shaping the hydropower turbine market, as operators must comply with various federal and state laws aimed at protecting aquatic ecosystems. The U.S. Environmental Protection Agency (EPA) has implemented guidelines that require hydropower facilities to minimize their ecological footprint. Compliance with these regulations often necessitates the installation of more efficient turbines that reduce environmental impact. As a result, the market is witnessing a shift towards eco-friendly turbine technologies, which may account for an estimated 30% of new installations by 2030. This trend underscores the importance of regulatory frameworks in driving innovation within the hydropower turbine market.

Infrastructure Upgrades and Modernization

The ongoing need for infrastructure upgrades in the U.S. is significantly impacting the hydropower turbine market. Many existing hydropower facilities are aging and require modernization to enhance efficiency and output. The U.S. Department of Energy has allocated over $100 million for research and development in hydropower technologies, indicating a strong commitment to improving existing systems. This investment is expected to lead to the adoption of advanced turbine designs and materials, which could increase energy generation capacity by up to 20%. Consequently, the modernization of infrastructure is likely to drive growth in the hydropower turbine market.

Technological Innovations in Turbine Design

Technological innovations are transforming the hydropower turbine market, with advancements in turbine design leading to improved efficiency and performance. Recent developments, such as the introduction of variable speed turbines, allow for better adaptation to fluctuating water flows, potentially increasing energy output by 15%. Furthermore, the use of computational fluid dynamics in turbine design is enabling manufacturers to create more efficient models that reduce maintenance costs and enhance longevity. As these innovations continue to emerge, they are likely to attract new investments and drive growth in the hydropower turbine market.

Rising Investment in Energy Storage Solutions

The hydropower turbine market is likely to benefit from the increasing investment in energy storage solutions, which are essential for balancing supply and demand in renewable energy systems. As hydropower facilities can serve as both energy producers and storage systems, their role is becoming more critical. The U.S. energy storage market is projected to reach $10 billion by 2027, with hydropower playing a pivotal role in this growth. The integration of pumped storage hydropower systems is expected to enhance grid stability and reliability, thereby fostering further investment in the hydropower turbine market.