Investment in Infrastructure

The hydropower market in the US is experiencing a surge in investment aimed at modernizing and expanding existing infrastructure. With an estimated $70 billion allocated for hydropower projects over the next decade, stakeholders are focusing on enhancing efficiency and capacity. This investment is crucial for maintaining the competitiveness of hydropower as a renewable energy source. Furthermore, the aging infrastructure of many facilities necessitates upgrades to meet current energy demands and environmental standards. As a result, the hydropower market is likely to see a significant increase in operational capacity, which could lead to a rise in energy production and a reduction in reliance on fossil fuels.

Climate Change Mitigation Efforts

Efforts to mitigate climate change are driving growth in the hydropower market. As the US government and various states commit to reducing carbon emissions, hydropower is recognized as a key player in achieving these goals. The hydropower market is likely to benefit from policies that promote clean energy sources, as hydropower provides a low-carbon alternative to fossil fuels. Additionally, the integration of hydropower into broader climate strategies may lead to increased funding and support for new projects. This focus on sustainability not only aligns with environmental objectives but also enhances the resilience of energy systems against climate-related disruptions.

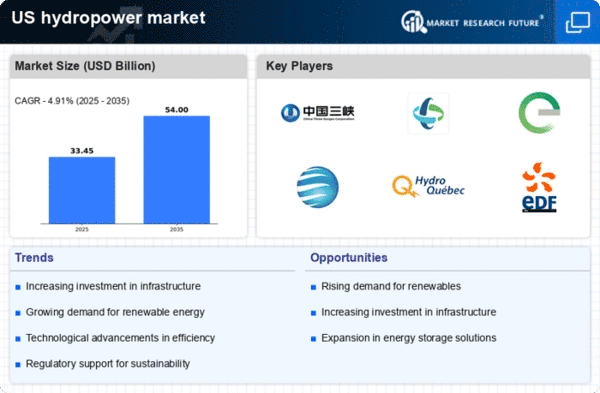

Growing Demand for Renewable Energy

The increasing demand for renewable energy sources is a primary driver for the hydropower market in the US. As states implement more stringent renewable energy mandates, hydropower is positioned as a reliable and sustainable option. Currently, hydropower accounts for approximately 7% of the total electricity generation in the US, and this figure is expected to rise as more projects come online. The hydropower market is likely to benefit from this trend, as utilities seek to diversify their energy portfolios and reduce greenhouse gas emissions. This shift towards renewables not only supports environmental goals but also enhances energy security, making hydropower an attractive investment.

Technological Advancements in Energy Storage

Technological advancements in energy storage solutions are significantly impacting the hydropower market. Innovations such as pumped storage hydropower are enhancing the ability to store energy generated during peak production times. This capability is essential for balancing supply and demand, particularly as the share of intermittent renewable sources like wind and solar increases. The hydropower market is likely to see a rise in hybrid systems that integrate hydropower with advanced storage technologies, potentially increasing overall efficiency and reliability. As energy storage technologies continue to evolve, they may provide new opportunities for hydropower facilities to optimize their operations and contribute to grid stability.

Public Awareness and Support for Clean Energy

Public awareness regarding the benefits of clean energy is rising, which positively influences the hydropower market. As communities become more informed about the environmental and economic advantages of renewable energy, support for hydropower projects is increasing. This trend is reflected in local initiatives and grassroots movements advocating for sustainable energy solutions. The hydropower market is likely to see enhanced public engagement, which can lead to smoother project approvals and increased funding opportunities. Furthermore, as consumers demand cleaner energy options, utilities may prioritize hydropower in their energy mix, further solidifying its role in the US energy landscape.