Emphasis on Enhanced User Experience

User experience is becoming a focal point in the enterprise video market in India, as organizations strive to provide seamless and intuitive video solutions. The demand for user-friendly interfaces and reliable performance is on the rise, with businesses seeking platforms that minimize technical difficulties and enhance engagement. Research indicates that companies that prioritize user experience in their video solutions can see a 25% increase in user adoption rates. This emphasis on usability is driving innovation within the enterprise video market, as providers develop features that cater to user preferences and behaviors. As a result, organizations are more likely to invest in video solutions that offer a superior user experience, thereby contributing to the overall growth of the market.

Rising Demand for Remote Collaboration

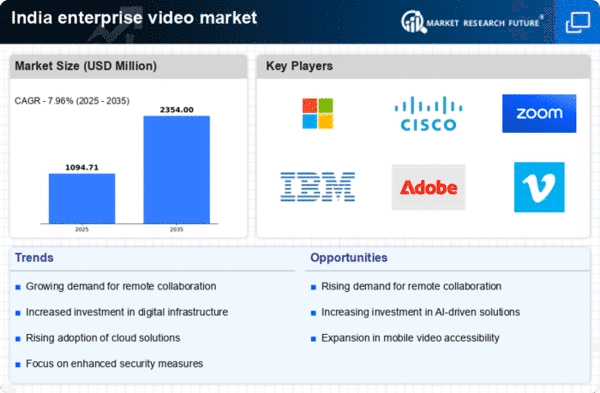

The enterprise video market in India experiences a notable surge in demand for remote collaboration tools. As organizations increasingly adopt hybrid work models, the need for effective communication solutions becomes paramount. Video conferencing platforms facilitate seamless interactions among teams, regardless of geographical barriers. According to recent data, the market for video conferencing solutions in India is projected to grow at a CAGR of approximately 20% over the next five years. This growth is driven by the necessity for real-time collaboration and the ability to conduct virtual meetings efficiently. Consequently, businesses are investing in advanced video technologies to enhance productivity and maintain connectivity. The enterprise video market is thus positioned to benefit significantly from this trend, as companies seek to optimize their communication strategies and foster a collaborative work environment.

Technological Advancements in Video Solutions

Technological innovations play a crucial role in shaping the enterprise video market in India. The introduction of high-definition video, artificial intelligence, and machine learning capabilities enhances user experience and engagement. These advancements enable features such as real-time language translation, automated transcription, and improved video quality, which are increasingly sought after by businesses. As organizations strive for efficiency, the integration of these technologies into video solutions becomes essential. Reports indicate that the adoption of AI-driven video analytics is expected to rise, with a potential increase of 30% in usage among enterprises by 2026. This evolution within the enterprise video market not only streamlines operations but also provides valuable insights into user behavior, thereby allowing companies to tailor their offerings more effectively.

Increased Investment in Digital Transformation

The enterprise video market in India is witnessing a surge in investment as organizations prioritize digital transformation initiatives. Companies are increasingly recognizing the importance of integrating video solutions into their digital strategies to enhance customer engagement and operational efficiency. The push towards digitalization is evident, with a reported increase of 40% in IT budgets allocated for digital tools, including video conferencing and collaboration platforms. This trend is likely to continue as businesses aim to remain competitive in a rapidly evolving market. The enterprise video market stands to gain from this influx of investment, as organizations seek to leverage video technology to improve communication, streamline processes, and foster innovation.

Growing Focus on Employee Training and Development

The enterprise video market in India is significantly influenced by the growing emphasis on employee training and development. Organizations recognize the value of video content in delivering training programs, as it enhances learning experiences and retention rates. The use of video for onboarding and continuous education is becoming a standard practice, with many companies reporting improved employee performance as a result. Data suggests that approximately 70% of organizations in India are now utilizing video-based training solutions, reflecting a shift towards more engaging and interactive learning methods. This trend indicates a robust opportunity for the enterprise video market, as businesses seek to invest in platforms that facilitate effective training and knowledge sharing among employees.