Growth of Oncology Clinics

The proliferation of oncology clinics across India serves as a substantial driver for the compounding chemotherapy market. With the establishment of specialized cancer treatment centers, there is a heightened focus on providing comprehensive care, including personalized chemotherapy regimens. The number of oncology clinics has increased by approximately 30% over the past five years, reflecting a growing recognition of the need for specialized cancer care. These clinics often require compounded chemotherapy drugs to meet the unique needs of their patients, which in turn stimulates market growth. As more patients seek treatment at these facilities, the demand for compounded chemotherapy solutions is expected to rise, further solidifying the market's position within the healthcare landscape.

Increasing Cancer Incidence

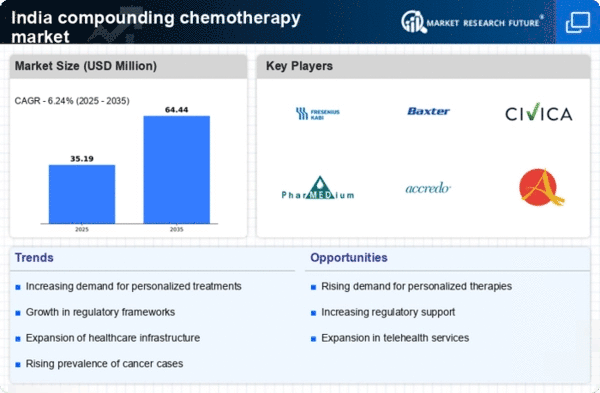

The rising incidence of cancer in India is a critical driver for the compounding chemotherapy market. According to the National Cancer Registry Programme, cancer cases are projected to increase significantly, with an estimated 1.5 million new cases expected by 2025. This surge in cancer diagnoses necessitates tailored treatment options, thereby boosting the demand for compounded chemotherapy solutions. As healthcare providers seek to offer personalized therapies, the compounding chemotherapy market is likely to expand. The increasing awareness about cancer treatment options among patients and healthcare professionals further propels this market. Consequently, the compounding chemotherapy market is positioned to grow as it addresses the specific needs of patients requiring customized drug formulations.

Rising Healthcare Expenditure

The increase in healthcare expenditure in India is a notable driver for the compounding chemotherapy market. With the government and private sectors investing more in healthcare infrastructure, the overall spending on cancer treatment has risen. Reports indicate that healthcare expenditure in India is expected to reach approximately $370 billion by 2025, which includes significant allocations for oncology services. This financial commitment enables healthcare facilities to enhance their offerings, including the procurement of compounded chemotherapy drugs. As patients gain access to better healthcare services, the demand for personalized chemotherapy solutions is anticipated to grow, thereby positively impacting the compounding chemotherapy market.

Regulatory Framework Enhancements

The evolving regulatory framework in India is playing a pivotal role in shaping the compounding chemotherapy market. Recent initiatives by the Central Drugs Standard Control Organization (CDSCO) aim to streamline the approval process for compounded drugs, ensuring that they meet safety and efficacy standards. This regulatory support fosters a more conducive environment for compounding pharmacies to operate, thereby increasing the availability of customized chemotherapy options. As regulations become more favorable, the compounding chemotherapy market is likely to benefit from enhanced trust among healthcare providers and patients. This trust is essential for the growth of the market, as it encourages the adoption of compounded therapies in cancer treatment.

Advancements in Pharmaceutical Technology

Technological advancements in pharmaceutical compounding are significantly influencing the compounding chemotherapy market. Innovations in drug formulation and delivery systems have enhanced the ability to create customized chemotherapy treatments that cater to individual patient needs. For instance, the introduction of automated compounding systems has improved accuracy and efficiency in drug preparation, reducing the risk of errors. This technological evolution not only ensures higher quality standards but also increases the availability of compounded chemotherapy drugs. As healthcare providers adopt these advanced technologies, the compounding chemotherapy market is likely to experience substantial growth, driven by the demand for safer and more effective treatment options.