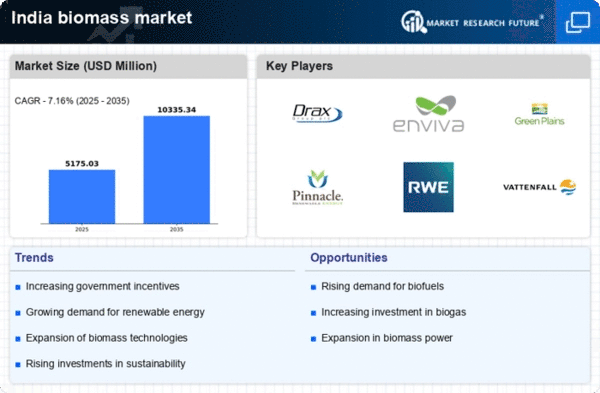

The biomass market in India is currently characterized by a dynamic competitive landscape, driven by increasing energy demands and a growing emphasis on renewable energy sources. Key players such as Drax Group (GB), Enviva (US), and RWE (DE) are actively shaping the market through strategic initiatives aimed at enhancing their operational capabilities and market reach. Drax Group (GB) has positioned itself as a leader in biomass energy production, focusing on innovation in sustainable practices and technology integration. Meanwhile, Enviva (US) emphasizes its commitment to sustainability, leveraging partnerships to expand its supply chain and enhance its biomass sourcing capabilities. RWE (DE) is also making strides in the market, concentrating on regional expansion and the development of new biomass facilities to meet the rising demand for renewable energy in India.The business tactics employed by these companies reflect a concerted effort to optimize supply chains and localize manufacturing processes. The market structure appears moderately fragmented, with several players vying for market share while also collaborating on sustainability initiatives. This collective influence of key players fosters a competitive environment that encourages innovation and efficiency, ultimately benefiting the biomass market as a whole.

In October Drax Group (GB) announced a significant investment in a new biomass facility in India, aimed at increasing its production capacity by 30%. This strategic move is expected to enhance Drax's ability to meet the growing energy demands in the region while reinforcing its commitment to sustainable energy solutions. The investment not only signifies Drax's confidence in the Indian market but also highlights the potential for biomass to play a crucial role in the country's energy transition.

In September Enviva (US) entered into a partnership with a local Indian firm to enhance its biomass sourcing capabilities. This collaboration is likely to streamline supply chain operations and improve the sustainability of biomass production in the region. By leveraging local expertise, Enviva aims to strengthen its market position and ensure a reliable supply of biomass feedstock, which is essential for its growth strategy in India.

In August RWE (DE) launched a new digital platform designed to optimize biomass logistics and supply chain management. This initiative reflects RWE's commitment to integrating advanced technologies into its operations, potentially leading to increased efficiency and reduced operational costs. The platform is expected to facilitate better coordination among suppliers and enhance the overall reliability of biomass supply in the Indian market.

As of November the competitive trends in the biomass market are increasingly defined by digitalization, sustainability, and the integration of advanced technologies. Strategic alliances among key players are shaping the landscape, fostering innovation and collaboration. The shift from price-based competition to a focus on technological advancement and supply chain reliability is becoming evident. Companies that prioritize innovation and sustainable practices are likely to differentiate themselves in this evolving market, positioning themselves for long-term success.