Rising Energy Demand

The Global Biomass Power Generation Market Industry is experiencing a surge in energy demand driven by population growth and industrialization. As countries strive to meet their energy needs sustainably, biomass power generation emerges as a viable alternative. In 2024, the market is valued at approximately 44.5 USD Billion, reflecting a growing recognition of biomass as a renewable energy source. This trend is particularly evident in regions with abundant biomass resources, such as agricultural waste and forestry residues, which can be converted into energy. The increasing reliance on biomass contributes to the overall growth of the global energy sector.

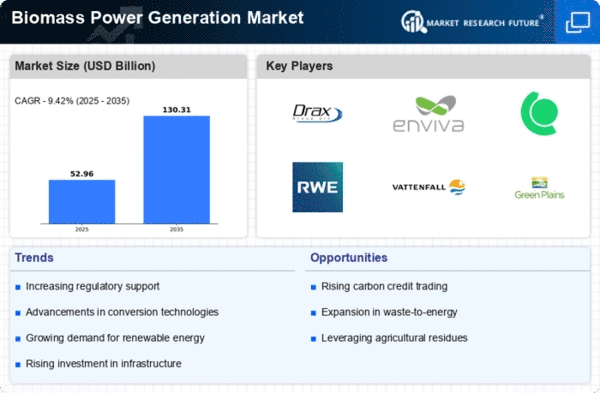

Market Growth Projections

The Global Biomass Power Generation Market Industry is poised for substantial growth, with projections indicating a compound annual growth rate (CAGR) of 9.35% from 2025 to 2035. This growth trajectory is underpinned by increasing investments in renewable energy infrastructure and a growing emphasis on energy security. As countries seek to diversify their energy portfolios and reduce reliance on fossil fuels, biomass power generation is expected to play a crucial role. The market's expansion is likely to be fueled by advancements in technology, supportive government policies, and rising public awareness of sustainable energy solutions.

Technological Advancements

Technological advancements are significantly influencing the Global Biomass Power Generation Market Industry. Innovations in biomass conversion technologies, such as gasification and anaerobic digestion, are enhancing efficiency and reducing costs. These advancements enable the conversion of a wider range of biomass feedstocks into energy, thereby expanding the market's potential. For example, the development of advanced biogas systems allows for the effective utilization of organic waste, contributing to energy generation while addressing waste management challenges. As technology continues to evolve, it is likely to drive further investment and growth in the biomass sector, fostering a more sustainable energy landscape.

Government Policies and Incentives

Government policies play a pivotal role in shaping the Global Biomass Power Generation Market Industry. Many countries are implementing favorable regulations and incentives to promote renewable energy sources, including biomass. These initiatives often include tax credits, grants, and subsidies aimed at reducing the financial burden on biomass projects. For instance, the European Union has set ambitious renewable energy targets, encouraging member states to invest in biomass technologies. Such supportive frameworks not only enhance the attractiveness of biomass power generation but also align with global efforts to reduce greenhouse gas emissions and combat climate change.

Environmental Concerns and Sustainability

Growing environmental concerns are propelling the Global Biomass Power Generation Market Industry forward. As awareness of climate change and environmental degradation increases, there is a pressing need for cleaner energy sources. Biomass power generation offers a sustainable alternative to fossil fuels, as it utilizes organic materials that can be replenished. This shift towards sustainability is reflected in the projected market growth, with estimates indicating a rise to 119.1 USD Billion by 2035. The ability of biomass to reduce carbon emissions and promote circular economy principles positions it as a key player in the global transition towards a more sustainable energy future.

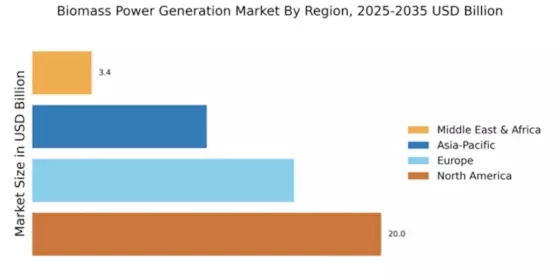

Market Diversification and Feedstock Availability

The Global Biomass Power Generation Market Industry benefits from a diverse range of feedstocks, which enhances its resilience and adaptability. Biomass can be sourced from agricultural residues, forestry by-products, and dedicated energy crops, providing flexibility in energy production. This diversity not only mitigates supply risks but also allows for localized energy solutions tailored to specific regions. For instance, countries with abundant agricultural activities can leverage crop residues for biomass energy, thereby supporting local economies. As the market continues to diversify, it is likely to attract investments and foster innovation, further solidifying its role in the global energy landscape.