Rising Energy Demand

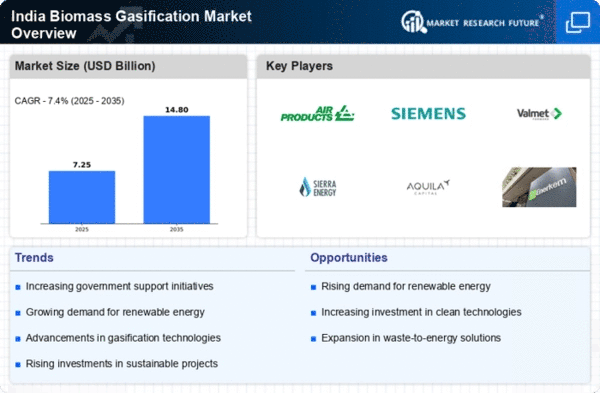

The increasing energy demand in India is a crucial driver for the biomass gasification market. As the population grows and urbanization accelerates, the need for sustainable energy sources becomes more pressing. The Indian government aims to achieve 175 GW of renewable energy capacity by 2022, with biomass playing a significant role. Biomass gasification can convert agricultural residues and waste into energy, thus addressing both energy needs and waste management. This dual benefit positions biomass gasification as a viable solution in the energy mix. Furthermore, the market is projected to grow at a CAGR of around 10% from 2025 to 2030, indicating a robust future for this sector. The rising energy demand, coupled with government initiatives, is likely to propel the biomass gasification market forward.

Technological Innovations

Technological innovations are playing a pivotal role in advancing the biomass gasification market. Recent developments in gasification technologies have improved efficiency and reduced costs, making biomass a more competitive energy source. Innovations such as fluidized bed gasifiers and integrated gasification combined cycle (IGCC) systems are enhancing the viability of biomass gasification. The Indian government is actively supporting research and development in this area, which could lead to breakthroughs that further optimize biomass conversion processes. As technology continues to evolve, the biomass gasification market is expected to expand, attracting investments and fostering new projects. The potential for improved efficiency and lower operational costs may significantly enhance the attractiveness of biomass gasification as a sustainable energy solution.

Agricultural Waste Utilization

India's agricultural sector generates vast amounts of waste, which presents a significant opportunity for the biomass gasification market. With approximately 500 million tons of agricultural waste produced annually, converting this waste into energy through gasification can address both energy and waste management challenges. The government has recognized this potential and is encouraging the use of agricultural residues for energy production. Initiatives such as the Pradhan Mantri Ujjwala Yojana aim to promote cleaner cooking fuels, indirectly supporting biomass gasification. The utilization of agricultural waste not only contributes to energy generation but also enhances farmers' income by providing an additional revenue stream. This dual benefit is likely to drive the growth of the biomass gasification market in India.

Policy Incentives and Financial Support

Policy incentives and financial support from the Indian government are crucial drivers for the biomass gasification market. Various schemes and subsidies are in place to encourage investments in renewable energy technologies, including biomass gasification. The National Bioenergy Mission aims to promote the use of biomass for energy generation, providing financial assistance to projects that utilize biomass gasification. Additionally, the government has introduced feed-in tariffs and tax incentives to make biomass energy projects more financially viable. These supportive policies are likely to stimulate growth in the biomass gasification market, attracting both domestic and international investors. As financial barriers are reduced, the market is expected to witness increased activity and innovation.

Environmental Sustainability Initiatives

Environmental sustainability is increasingly becoming a priority in India, driving the biomass gasification market. The government has set ambitious targets to reduce carbon emissions and promote cleaner energy sources. Biomass gasification offers a pathway to convert waste into energy, thereby reducing landfill use and greenhouse gas emissions. The Indian Ministry of Environment, Forest and Climate Change has been promoting technologies that utilize biomass for energy production. This aligns with the global shift towards sustainable practices, making biomass gasification an attractive option. The market is expected to benefit from various incentives and subsidies aimed at promoting cleaner technologies, potentially increasing market penetration. As environmental regulations tighten, the biomass gasification market is likely to see heightened interest from both public and private sectors.