Rising Environmental Concerns

The automotive electric-bus market is experiencing a surge in demand due to increasing environmental concerns among the Indian populace. As urban air quality deteriorates, citizens are becoming more aware of the detrimental effects of traditional diesel buses on health and the environment. This awareness is prompting local governments and municipalities to seek cleaner alternatives, thereby driving the adoption of electric buses. Reports indicate that cities like Delhi have set ambitious targets to reduce air pollution by 30% by 2025, which aligns with the shift towards electric mobility. Consequently, the automotive electric-bus market is likely to benefit from this growing emphasis on sustainability, as stakeholders prioritize eco-friendly transportation solutions.

Public Awareness and Acceptance

Public awareness and acceptance of electric vehicles are steadily increasing, positively impacting the automotive electric-bus market. Campaigns aimed at educating the public about the benefits of electric buses, such as lower operating costs and reduced emissions, are gaining traction. Surveys indicate that a growing number of commuters express a preference for electric buses over conventional options, reflecting a shift in consumer attitudes. This change in perception is crucial for the automotive electric-bus market, as it encourages transport authorities to invest in electric fleets, thereby fostering a more sustainable public transportation ecosystem.

Economic Incentives and Subsidies

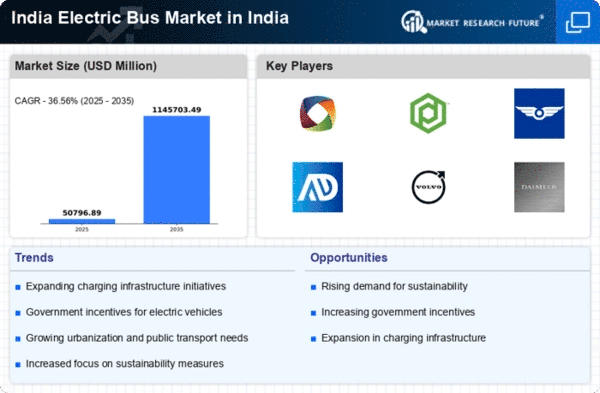

The automotive electric-bus market is bolstered by various economic incentives and subsidies provided by the Indian government. These financial aids are designed to lower the initial investment costs associated with electric buses, making them more accessible to public transport operators. For instance, the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme has allocated substantial funds to promote electric mobility. As of 2025, the government has committed over $1 billion to support the deployment of electric buses across major cities. This financial backing not only encourages the adoption of electric buses but also stimulates growth within the automotive electric-bus market, as manufacturers and operators are more inclined to invest in electric fleets.

Urbanization and Population Growth

Rapid urbanization and population growth in India are significant drivers of the automotive electric-bus market. As cities expand and populations increase, the demand for efficient public transportation systems intensifies. Electric buses are emerging as a viable solution to address the challenges posed by urban congestion and pollution. According to projections, urban populations in India are expected to reach 600 million by 2031, necessitating a shift towards sustainable transport options. This demographic shift is likely to propel the automotive electric-bus market, as city planners and transport authorities seek to modernize their fleets to accommodate growing passenger numbers while minimizing environmental impact.

Technological Innovations in Battery Technology

Advancements in battery technology are playing a crucial role in shaping the automotive electric-bus market. Innovations such as solid-state batteries and improved lithium-ion technologies are enhancing the efficiency and range of electric buses. These developments are critical, as range anxiety has been a significant barrier to the widespread adoption of electric vehicles. As battery costs decrease and performance improves, electric buses are becoming more competitive with traditional diesel models. The automotive electric-bus market is likely to see increased investment in research and development, as manufacturers strive to leverage these technological advancements to offer more reliable and cost-effective electric buses.