Regulatory Framework Enhancements

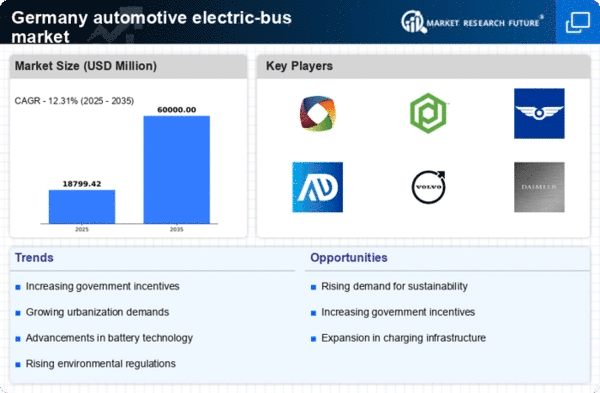

The automotive electric-bus market in Germany is experiencing a robust transformation due to the implementation of stringent regulatory frameworks aimed at reducing emissions. The German government has established ambitious targets for carbon neutrality, which necessitate a shift towards electric public transport solutions. As of 2025, regulations mandate that new public transport vehicles must meet specific emission standards, thereby driving the adoption of electric buses. This regulatory environment not only encourages manufacturers to innovate but also compels public transport authorities to invest in electric fleets. The automotive electric-bus market is thus positioned to benefit from these regulations, which are expected to lead to a substantial increase in electric bus deployments across urban areas.

Environmental Sustainability Goals

The automotive electric-bus market in Germany is significantly influenced by the increasing emphasis on environmental sustainability. Public awareness regarding climate change and air quality issues has led to heightened demand for cleaner public transport solutions. As cities strive to meet sustainability goals, electric buses are emerging as a preferred option due to their zero-emission capabilities. By 2025, it is anticipated that cities across Germany will implement policies favoring electric buses, further propelling the automotive electric-bus market. This shift not only aligns with national and EU-wide environmental targets but also enhances the public image of transport authorities committed to sustainable practices.

Economic Viability and Cost Savings

The automotive electric-bus market in Germany is increasingly viewed as economically viable due to the declining costs of electric bus technology. The total cost of ownership for electric buses is becoming more favorable compared to traditional diesel buses. As of 2025, operational costs for electric buses are estimated to be 30% lower than their diesel counterparts, primarily due to reduced fuel and maintenance expenses. This economic advantage is prompting public transport authorities to reconsider their fleet compositions, leading to a surge in electric bus acquisitions. Consequently, the automotive electric-bus market is likely to witness accelerated growth as financial considerations become a driving force behind fleet modernization.

Infrastructure Development Initiatives

Infrastructure development plays a pivotal role in the growth of the automotive electric-bus market in Germany. The government is investing heavily in charging infrastructure to support the transition to electric vehicles. By 2025, it is projected that the number of charging stations will increase by over 50%, facilitating the operational efficiency of electric buses. This investment is crucial as it addresses one of the primary barriers to electric bus adoption: range anxiety. Enhanced infrastructure not only supports existing electric buses but also attracts new investments in the automotive electric-bus market, as manufacturers and operators seek to capitalize on improved operational capabilities.

Technological Innovations in Electric Mobility

Technological advancements are reshaping the automotive electric-bus market in Germany, with innovations in electric mobility driving growth. Developments in battery technology, such as increased energy density and faster charging capabilities, are enhancing the performance of electric buses. As of 2025, new battery systems are expected to offer ranges exceeding 500 km on a single charge, making electric buses more practical for urban transit. These innovations are likely to attract more operators to the automotive electric-bus market, as they seek to leverage cutting-edge technology to improve service reliability and efficiency. The continuous evolution of technology thus serves as a catalyst for market expansion.