Regulatory Support and Approvals

Regulatory bodies are increasingly recognizing the potential of implantable drug delivery systems, which is positively impacting the Implantable Drug Delivery Device Market. Streamlined approval processes and supportive regulations are facilitating the introduction of new devices into the market. For example, the FDA has implemented initiatives to expedite the review of innovative medical devices, which encourages manufacturers to invest in research and development. This regulatory support not only fosters innovation but also enhances patient access to advanced treatment options. As a result, the market is likely to witness a proliferation of new products, contributing to its expansion.

Growing Focus on Personalized Medicine

The shift towards personalized medicine is significantly influencing the Implantable Drug Delivery Device Market. Tailoring treatment to individual patient profiles enhances therapeutic efficacy and minimizes adverse effects. Implantable devices can be designed to release drugs based on specific patient characteristics, such as genetic makeup or disease stage. This trend aligns with the broader movement in healthcare towards individualized treatment plans, which are becoming increasingly feasible due to advancements in biotechnology. The market is expected to benefit from this focus on personalization, as healthcare providers seek to improve patient outcomes through more targeted therapies.

Increasing Prevalence of Chronic Diseases

The rising prevalence of chronic diseases is a primary driver for the Implantable Drug Delivery Device Market. Conditions such as diabetes, cardiovascular diseases, and cancer require long-term management strategies, which implantable devices can effectively provide. According to recent statistics, chronic diseases account for approximately 70% of all deaths worldwide, highlighting the urgent need for innovative treatment solutions. Implantable drug delivery systems offer a means to administer medication consistently and efficiently, reducing the burden on healthcare systems. As the population ages and the incidence of chronic conditions rises, the demand for these devices is expected to escalate, further propelling market growth.

Technological Innovations in Drug Delivery

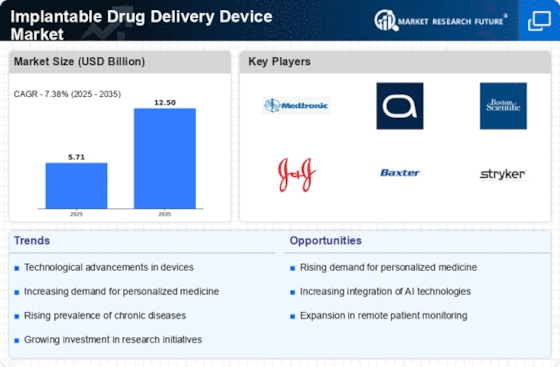

The Implantable Drug Delivery Device Market is experiencing a surge in technological innovations that enhance the efficacy and safety of drug delivery systems. Advanced materials, such as biocompatible polymers and smart drug delivery systems, are being developed to improve patient outcomes. For instance, the integration of microelectronics allows for programmable drug release, which can be tailored to individual patient needs. This adaptability is crucial for managing complex conditions, such as cancer and diabetes, where precise dosing is essential. The market is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of over 10% in the coming years, driven by these technological advancements.

Rising Investment in Healthcare Infrastructure

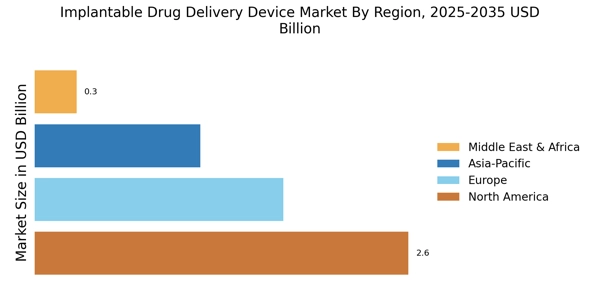

Investment in healthcare infrastructure is a crucial driver for the Implantable Drug Delivery Device Market. Governments and private entities are allocating substantial resources to enhance healthcare facilities and technologies, which includes the adoption of advanced drug delivery systems. Improved healthcare infrastructure facilitates better access to innovative treatments, including implantable devices, particularly in emerging markets. As healthcare systems evolve, the demand for efficient and effective drug delivery solutions is likely to increase. This trend is expected to bolster market growth, as more patients gain access to these advanced therapeutic options.