Technological Advancements in Image Intensifier Tube Market

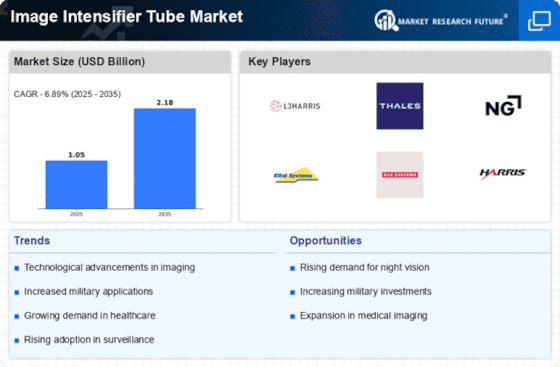

The Image Intensifier Tube Market is experiencing a surge in technological advancements that enhance the performance and efficiency of image intensifier tubes. Innovations such as improved photocathode materials and advanced electronic components are leading to higher sensitivity and resolution. For instance, the introduction of multi-alkali photocathodes has been shown to increase the spectral response, thereby improving image quality in low-light conditions. Furthermore, the integration of digital technologies with traditional image intensifiers is creating hybrid systems that offer enhanced functionalities. This trend is expected to drive the market, as manufacturers seek to meet the growing demand for high-performance imaging solutions across various sectors, including defense, medical, and industrial applications.

Rising Demand in Medical Imaging within Image Intensifier Tube Market

The Image Intensifier Tube Market is experiencing rising demand in the medical imaging sector, particularly in fluoroscopy and radiography applications. Image intensifier tubes are essential components in various imaging systems, providing enhanced visibility and detail during medical procedures. The increasing prevalence of chronic diseases and the aging population are driving the need for advanced diagnostic tools, which in turn boosts the demand for image intensifier tubes. Market data suggests that the medical imaging segment is projected to grow at a rate of approximately 6% annually, reflecting the critical role of these technologies in improving patient outcomes and diagnostic accuracy. This trend underscores the importance of innovation and investment in the medical imaging domain.

Increased Military and Security Applications in Image Intensifier Tube Market

The Image Intensifier Tube Market is witnessing a notable increase in demand driven by military and security applications. As nations prioritize national security, the need for advanced surveillance and reconnaissance systems has escalated. Image intensifier tubes play a crucial role in night vision devices, enabling military personnel to operate effectively in low-light environments. According to recent data, the defense sector accounts for a substantial share of the market, with projections indicating a compound annual growth rate of over 5% in the coming years. This growth is likely fueled by ongoing military modernization programs and the increasing adoption of night vision technologies in law enforcement agencies, further solidifying the market's expansion.

Growing Adoption of Night Vision Technologies in Image Intensifier Tube Market

The Image Intensifier Tube Market is benefiting from the growing adoption of night vision technologies across various sectors. As industries such as agriculture, wildlife monitoring, and security increasingly recognize the value of night vision capabilities, the demand for image intensifier tubes is expected to rise. These technologies enable users to conduct operations in complete darkness, enhancing safety and efficiency. Recent market analysis indicates that the agricultural sector is particularly keen on utilizing night vision for monitoring crops and livestock, which could lead to a significant increase in market share. This trend suggests a broader acceptance of image intensifier tubes beyond traditional military applications, potentially expanding the market's reach.

Emerging Applications in Industrial Inspection within Image Intensifier Tube Market

The Image Intensifier Tube Market is witnessing emerging applications in industrial inspection, which is contributing to its growth. Industries such as manufacturing and construction are increasingly utilizing image intensifier tubes for non-destructive testing and quality control processes. These tubes facilitate the detection of flaws and irregularities in materials, ensuring product integrity and safety. The market for industrial inspection is projected to grow at a compound annual growth rate of around 4% over the next few years, driven by stringent quality standards and the need for efficient inspection methods. This trend indicates a diversification of the image intensifier tube applications, further solidifying its relevance in various industrial sectors.