Rising Demand for Enhanced Night Vision

The military image-intensifier market is experiencing a notable increase in demand for advanced night vision capabilities. This trend is driven by the necessity for enhanced situational awareness during nighttime operations. Military forces are increasingly recognizing the importance of superior visibility in low-light conditions, which is critical for mission success. As a result, investments in image-intensifier technologies are projected to rise, with the market expected to reach approximately $1.5 billion by 2026. The integration of cutting-edge technologies, such as digital image processing and improved sensor technologies, is likely to further propel this demand, ensuring that military personnel can operate effectively in diverse environments.

Strategic Partnerships and Collaborations

The military image-intensifier market is experiencing growth driven by strategic partnerships and collaborations among defense contractors and technology firms. These alliances aim to leverage expertise in optics, electronics, and software development to create innovative image-intensifier solutions. Such collaborations are likely to enhance product offerings and accelerate the development of next-generation technologies. Recent partnerships have resulted in the introduction of advanced image-intensifiers that offer improved performance and durability. As the military seeks to modernize its capabilities, these strategic initiatives are expected to play a pivotal role in shaping the future landscape of the military image-intensifier market.

Growing Focus on Soldier Modernization Programs

The military image-intensifier market is significantly influenced by ongoing soldier modernization initiatives. These programs aim to enhance the capabilities of individual soldiers through the integration of advanced technologies, including image-intensifiers. As military organizations prioritize equipping their personnel with state-of-the-art gear, the demand for high-performance image-intensifiers is expected to surge. Reports indicate that the U.S. Department of Defense has allocated over $200 million for soldier modernization efforts in the upcoming fiscal year. This investment underscores the commitment to improving operational effectiveness and safety, thereby driving growth in the military image-intensifier market.

Technological Integration with Other Defense Systems

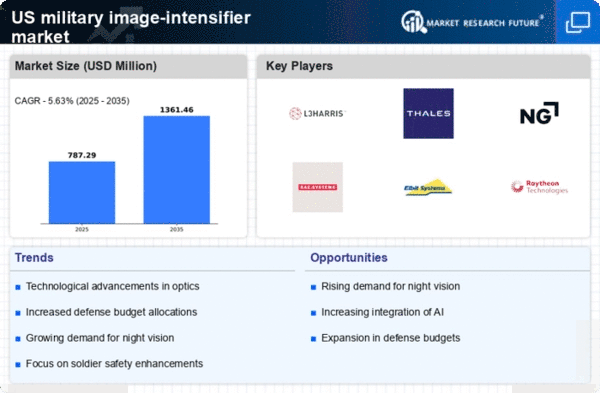

The military image-intensifier market is poised for growth due to the integration of image-intensifiers with other defense systems. As military operations become more complex, the need for interoperability among various systems is crucial. Image-intensifiers are increasingly being integrated with advanced targeting systems, drones, and command and control platforms. This integration enhances the overall effectiveness of military operations, allowing for improved decision-making and operational efficiency. The market is expected to witness a compound annual growth rate (CAGR) of 5.5% as defense contractors focus on developing multi-functional systems that incorporate image-intensifier technologies.

Increased Emphasis on Surveillance and Reconnaissance

The military image-intensifier market is benefiting from a heightened emphasis on surveillance and reconnaissance operations. As military strategies evolve, the need for real-time intelligence and situational awareness has become paramount. Image-intensifiers play a crucial role in enhancing the capabilities of surveillance systems, enabling military forces to gather critical information in various lighting conditions. The market is projected to grow at a CAGR of 6% over the next five years, driven by the increasing adoption of image-intensifier technologies in unmanned aerial vehicles (UAVs) and ground-based surveillance systems. This trend indicates a robust future for the military image-intensifier market.