Increased Military Spending

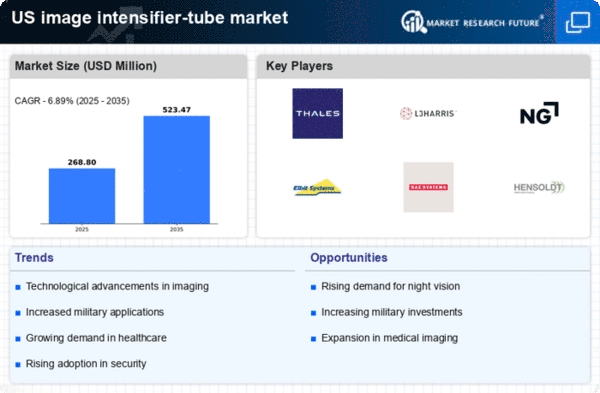

The image intensifier-tube market is experiencing a notable boost due to increased military spending in the United States. The U.S. government has allocated substantial budgets for defense modernization, which includes advanced surveillance and reconnaissance systems. This trend is likely to drive demand for image intensifier tubes, as they are essential components in night vision devices used by military personnel. In 2025, military expenditure is projected to reach approximately $800 billion, with a significant portion directed towards enhancing optical technologies. Consequently, the image intensifier-tube market is expected to benefit from this influx of funding, as defense contractors seek to integrate cutting-edge technologies into their systems.

Technological Innovations in Imaging

Technological innovations in imaging systems are significantly influencing the image intensifier-tube market. Advancements in materials and manufacturing processes have led to the development of more efficient and compact image intensifier tubes. These innovations enhance image quality and reduce power consumption, making them more appealing for various applications. For instance, the introduction of new phosphor materials has improved the sensitivity and resolution of night vision devices. As a result, the market is likely to see an increase in demand for these advanced tubes, particularly in sectors such as surveillance and medical imaging. The image intensifier-tube market is expected to evolve as manufacturers continue to innovate and meet the changing needs of consumers.

Rising Demand for Night Vision Devices

The growing demand for night vision devices in various sectors, including law enforcement and civilian applications, is a key driver for the image intensifier-tube market. As safety and security concerns escalate, law enforcement agencies are increasingly adopting advanced night vision technologies to enhance operational effectiveness. The market for night vision devices is anticipated to grow at a CAGR of around 8% from 2025 to 2030, indicating a robust demand for image intensifier tubes. This trend is further supported by the increasing popularity of outdoor recreational activities, where night vision devices are becoming essential for enthusiasts. Thus, the image intensifier-tube market is poised for growth as it caters to these diverse applications.

Growing Adoption in Medical Applications

The image intensifier-tube market is witnessing a growing adoption in medical applications, particularly in fluoroscopy and radiography. Medical imaging technologies that utilize image intensifier tubes are essential for real-time imaging during surgical procedures. The increasing prevalence of chronic diseases and the aging population in the United States are driving the demand for advanced medical imaging solutions. The market for medical imaging is projected to reach $50 billion by 2026, with a significant portion attributed to the use of image intensifier tubes. This trend indicates a promising future for the image intensifier-tube market as healthcare providers seek to enhance diagnostic capabilities and improve patient outcomes.

Emerging Applications in Consumer Electronics

Emerging applications in consumer electronics are contributing to the growth of the image intensifier-tube market. With the rise of augmented reality (AR) and virtual reality (VR) technologies, there is an increasing need for high-quality imaging solutions. Image intensifier tubes are being integrated into AR and VR devices to enhance user experiences by providing clearer and more immersive visuals. The consumer electronics market is expected to grow at a CAGR of 10% over the next five years, which could lead to a surge in demand for image intensifier tubes. As manufacturers explore new ways to incorporate these tubes into innovative products, the image intensifier-tube market is likely to expand, driven by consumer interest in advanced imaging technologies.