Government Incentives and Support

Government policies and incentives are playing a pivotal role in shaping the Hydrogen Energy Storage Market. Many nations are implementing supportive frameworks to promote hydrogen technologies, including grants, tax incentives, and research funding. For instance, several countries have allocated substantial budgets for hydrogen initiatives, with investments exceeding 10 billion USD in 2025 alone. These measures aim to stimulate innovation and accelerate the deployment of hydrogen energy solutions. As a result, the Hydrogen Energy Storage Market is likely to witness enhanced growth prospects, as favorable regulatory environments encourage private sector participation and investment in hydrogen infrastructure.

Increasing Demand for Renewable Energy

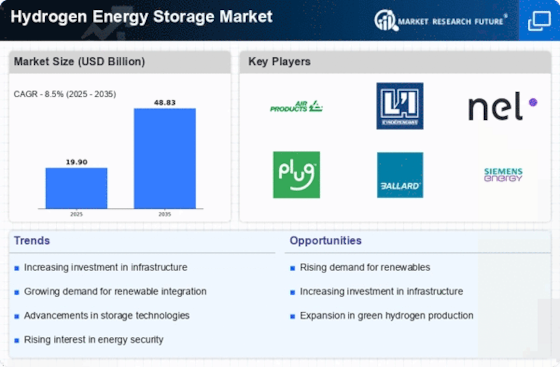

The Hydrogen Energy Storage Market is experiencing a surge in demand driven by the global transition towards renewable energy sources. As countries strive to meet ambitious carbon reduction targets, the integration of hydrogen as a clean energy carrier becomes increasingly vital. In 2025, the market for hydrogen energy storage is projected to reach approximately 20 billion USD, reflecting a compound annual growth rate of around 15%. This growth is largely attributed to the need for effective energy storage solutions that can balance intermittent renewable energy generation, such as solar and wind. Consequently, the Hydrogen Energy Storage Market is positioned to play a crucial role in facilitating the decarbonization of energy systems, thereby enhancing energy security and sustainability.

Integration with Existing Energy Systems

The integration of hydrogen energy storage with existing energy systems is emerging as a key driver for the Hydrogen Energy Storage Market. As energy systems evolve, the ability to incorporate hydrogen storage into current infrastructures presents significant opportunities. In 2025, it is estimated that over 40% of new energy projects will include hydrogen storage solutions, reflecting a shift towards hybrid energy systems. This integration not only enhances the resilience of energy supply but also facilitates the transition to a low-carbon economy. The Hydrogen Energy Storage Market stands to benefit from this trend, as stakeholders recognize the value of hydrogen in complementing traditional energy sources and improving overall system efficiency.

Rising Awareness of Energy Storage Solutions

The increasing awareness of the importance of energy storage solutions is driving growth in the Hydrogen Energy Storage Market. As energy consumers become more informed about the benefits of hydrogen storage, including its potential for long-duration energy storage, the market is expected to expand. In 2025, the demand for hydrogen storage systems is anticipated to rise by approximately 25%, as industries seek reliable and efficient energy storage options. This trend is particularly evident in sectors such as transportation and heavy industry, where the need for sustainable energy solutions is paramount. The Hydrogen Energy Storage Market is thus likely to capitalize on this growing awareness, leading to broader acceptance and implementation of hydrogen technologies.

Advancements in Hydrogen Production Technologies

Technological innovations in hydrogen production are significantly influencing the Hydrogen Energy Storage Market. The development of electrolysis technologies, particularly proton exchange membrane (PEM) electrolysis, has improved efficiency and reduced costs. As of 2025, the cost of green hydrogen production is expected to decrease by nearly 30% compared to previous years, making it a more attractive option for energy storage. This advancement not only enhances the viability of hydrogen as a storage medium but also encourages investment in hydrogen infrastructure. The Hydrogen Energy Storage Market is thus likely to benefit from these technological advancements, which may lead to increased adoption across various sectors, including transportation and industrial applications.