Top Industry Leaders in the Hydrogen Energy Storage Market

*Disclaimer: List of key companies in no particular order

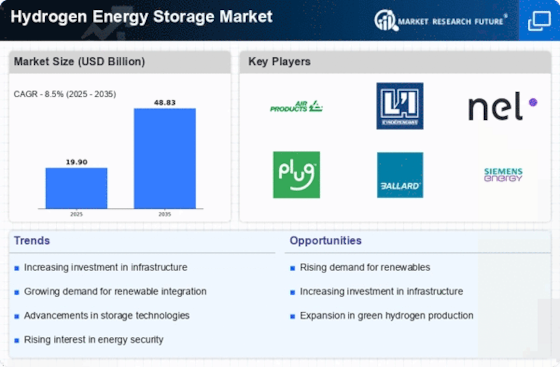

The hydrogen energy storage sector is undergoing rapid expansion, fueled by an escalating emphasis on clean energy sources and the pursuit of carbon neutrality objectives. This has given rise to an intense competitive environment, featuring both well-established entities and new contenders striving to secure their positions in the market. The ensuing discussion provides an overview of the principal players, their strategic maneuvers, market share dynamics, and emerging trends within the hydrogen energy storage landscape.

Key Players and Strategies:

Prominent contributors to the hydrogen energy storage market include VRV S.P.A, Hbank Technologies Inc., Inoxcva, Mcphy Energy S.A., Luxfer Holdings PLC, Worthington Industries Inc., Praxair Inc, Linde AG, Air Liquide, and others. Established entities from the industrial gas and energy sectors are actively engaged in the hydrogen energy storage market, with notable strategies including:

-

Air Liquide: Concentrating efforts on developing hydrogen infrastructure while fostering partnerships with energy companies and vehicle manufacturers. -

Air Products and Chemicals: Investing in large-scale hydrogen production facilities and liquefaction technologies. -

Linde: Broadening its hydrogen portfolio through investments in electrolysis, storage, and transportation solutions. -

Chart Industries: Holding a leading position in cryogenic hydrogen storage tanks and transportation equipment. -

Plug Power: Prioritizing fuel cell technology and the utilization of hydrogen-powered forklifts for industrial applications. -

ITM Power: Pioneering in PEM electrolyzer technology, supplying hydrogen solutions for transportation and energy sectors. -

Hydrogenics (Cummins): Offering an extensive range of electrolyzers, fuel cell stacks, and hydrogen storage solutions. -

Nel Hydrogen: Specializing in alkaline electrolyzers and hydrogen fueling stations. -

Worthington Industries: Providing hydrogen storage pressure vessels and transportation solutions. -

FuelCell Energy: Focusing on stationary fuel cell systems and microgrids for industrial and commercial applications.

These industry leaders are employing diverse strategies to fortify their market positions, such as forming strategic partnerships, investing significantly in research and development, expanding into new markets, and diversifying their product portfolios.

Factors for Market Share Analysis:

Several factors play a crucial role in determining market share within the hydrogen energy storage sector, including the breadth and depth of technology offerings, production capacity, geographical reach, financial strength, customer base, and brand reputation.

New and Emerging Trends:

The competitive landscape is continually shaped by new and emerging trends, including:

-

Decentralized Hydrogen Production: Leveraging renewable energy sources for on-site hydrogen production, particularly for industrial and transportation applications. -

Power-to-Gas Technologies: Converting surplus renewable energy into hydrogen for storage and subsequent use. -

Green Hydrogen: A focus on producing hydrogen using renewable energy to minimize the carbon footprint. -

Hydrogen Blending with Natural Gas: Injecting hydrogen into existing natural gas pipelines for cleaner energy distribution. -

Advanced Materials for Hydrogen Storage: Development of new materials to enhance storage capacity and efficiency. -

Digitalization and Automation: Utilizing digital technologies to optimize hydrogen production, storage, and distribution processes.

Overall Competitive Scenario:

The hydrogen energy storage market is witnessing heightened competition, with established players encountering challenges from new entrants. Foreseeably, the industry is anticipated to undergo significant consolidation in the coming years, with mergers and acquisitions leading to larger and more diversified players. In this dynamic and rapidly evolving market, innovation and collaboration will be pivotal for companies aiming to succeed.

Industry Developments and Latest Updates:

Recent developments include:

-

VRV S.P.A. (July 12, 2023): Securing a €12 million grant from the Italian Ministry of Economic Development for a project focused on developing advanced metal hydride materials for hydrogen storage. -

Hbank Technologies Inc. (November 3, 2023): Being awarded a contract by Chart Industries to supply metal hydride hydrogen storage tanks for a green hydrogen project in California. -

Inoxcva (September 20, 2023): Commencing the construction of a new €40 million facility in France to expand its production of high-pressure hydrogen cylinders.