Corporate Sustainability Initiatives

Corporate sustainability initiatives are increasingly influencing the hydrogen energy-storage market. Many companies are committing to net-zero emissions targets, prompting them to explore hydrogen as a clean energy alternative. For example, major corporations in the automotive and energy sectors are investing in hydrogen fuel cell technologies to meet their sustainability goals. This trend is expected to drive demand for hydrogen energy storage solutions, as businesses seek to reduce their carbon footprints. The market could see a substantial increase in corporate partnerships and investments, further propelling the hydrogen energy-storage market forward.

Regulatory Frameworks and Incentives

Regulatory frameworks and incentives play a pivotal role in shaping the hydrogen energy-storage market. The U.S. government has introduced various policies aimed at promoting hydrogen technologies, including tax credits and grants for research and development. These incentives are designed to lower the financial barriers associated with hydrogen projects, encouraging private sector participation. Additionally, state-level initiatives are emerging, with several states implementing their own hydrogen strategies to support local economies. Such regulatory support is likely to create a favorable environment for the hydrogen energy-storage market, fostering innovation and investment.

Investment in Infrastructure Development

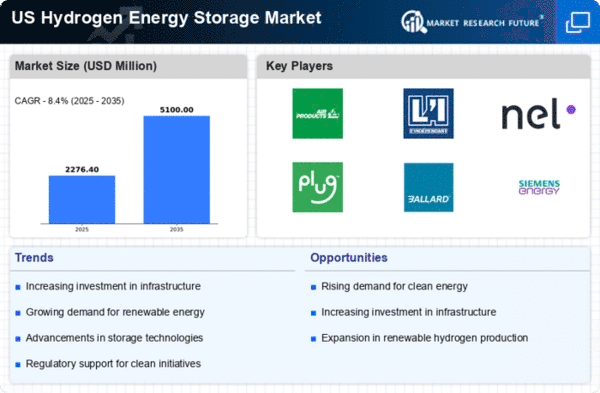

Investment in infrastructure development is a critical driver for the hydrogen energy-storage market. The establishment of hydrogen refueling stations and storage facilities is essential for the widespread adoption of hydrogen technologies. Recent reports indicate that the U.S. is expected to invest over $7 billion in hydrogen infrastructure by 2025, which will facilitate the integration of hydrogen into the existing energy landscape. This investment is likely to create a more robust supply chain, facilitating access to hydrogen for various applications, including transportation and industrial processes. Consequently, the growth of infrastructure is poised to significantly enhance the hydrogen energy-storage market.

Rising Demand for Clean Energy Solutions

The hydrogen energy-storage market is experiencing a surge in demand driven by the increasing need for clean energy solutions. As environmental concerns escalate, industries and consumers alike are seeking alternatives to fossil fuels. The U.S. government has set ambitious targets to reduce greenhouse gas emissions by 50-52% by 2030, likely bolstering investments in hydrogen technologies. Furthermore, the market is projected to reach approximately $11 billion by 2030, indicating a robust growth trajectory. This demand is not only limited to transportation but extends to various sectors, including industrial applications and power generation, thereby enhancing the hydrogen energy-storage market's potential.

Advancements in Hydrogen Production Technologies

Innovations in hydrogen production technologies are significantly impacting the hydrogen energy-storage market. The development of electrolysis methods, particularly those utilizing renewable energy sources, is becoming more efficient and cost-effective. For instance, the cost of producing green hydrogen has decreased by nearly 50% over the past few years, making it a more viable option for energy storage. Additionally, advancements in steam methane reforming and biomass gasification are also contributing to the diversification of hydrogen production methods. These technological improvements are expected to enhance the scalability and accessibility of hydrogen solutions, thereby driving growth in the hydrogen energy-storage market.