The Human Capital Management Market (HCM) Market is currently experiencing a transformative phase, driven by the increasing recognition of workforce optimization as a critical component of organizational success. Companies are increasingly investing in advanced technologies to enhance employee engagement, streamline recruitment processes, and improve overall talent management. This shift appears to be influenced by a growing understanding that effective human capital strategies can lead to improved productivity and competitive advantage. As organizations navigate the complexities of a dynamic labor market, the integration of data analytics and artificial intelligence into HCM solutions is becoming more prevalent, suggesting a future where data-driven decision-making is paramount. Moreover, the emphasis on employee well-being and development is reshaping the landscape of the Human Capital Management Market (HCM) Market.

Organizations are prioritizing initiatives that foster a positive workplace culture, promote diversity and inclusion, and support continuous learning. This trend indicates a broader societal shift towards valuing human resources not merely as assets but as integral components of a thriving business ecosystem. As the market evolves, it is likely that companies will continue to seek innovative solutions that align with their strategic goals, ultimately enhancing their ability to attract, retain, and develop talent in an increasingly competitive environment. The human capital management industry is witnessing rapid digital transformation, driven by cloud adoption, AI integration, and evolving workforce needs.

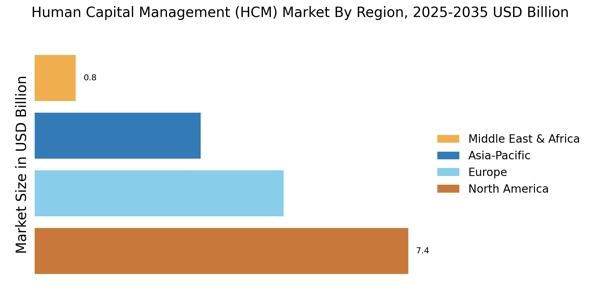

This human capital management report provides an in-depth analysis of the global human capital management software market through 2035. As per analysis, the HCM industry is projected to grow steadily, reflecting the expanding scope of the human capital management industry across enterprises worldwide. According to recent HR market research, organizations are increasingly prioritizing employee experience, workforce analytics, and AI-driven talent management solutions. Each human capital management company profiled in this report is evaluated based on product portfolio, regional presence, and innovation strategy. This human capital management report covers market sizing, competitive analysis, growth drivers, challenges, and future opportunities from 2025 to 2035.

Integration of Artificial Intelligence

The incorporation of artificial intelligence into HCM solutions is gaining traction, as organizations seek to automate processes and enhance decision-making. AI technologies can analyze vast amounts of data, providing insights that help in talent acquisition, employee performance evaluation, and workforce planning.

Focus on Employee Experience

There is a growing emphasis on improving employee experience within the Human Capital Management Market (HCM) Market. Companies are implementing strategies that prioritize employee engagement, well-being, and career development, recognizing that a satisfied workforce can lead to higher productivity and retention rates.

Adoption of Cloud-Based Solutions

The shift towards cloud-based HCM solutions is becoming increasingly prevalent. Organizations are opting for these platforms due to their scalability, flexibility, and cost-effectiveness, allowing for easier access to data and improved collaboration across teams.